Air Passenger Duty (APD) is a flat rate indirect tax on passengers who fly from UK airports.

Question:

Air Passenger Duty (APD) is a flat rate indirect tax on passengers who fly from UK airports. It is collected by the airlines who add the tax onto ticket prices. In 2009, the tax was £5 for economy class passengers travelling on flights within the European Union.

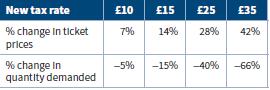

The table below summarises the likely effects of increases in APD on a typical flight.

a. Calculate the price elasticity of demand for each of the new tax rates.

b. Explain the meaning of each of the figures you have calculated.

c. Suppose the UK government wishes to reduce the demand for air travel for environmental reasons. Comment on how it might use the price elasticity of demand estimates to achieve this objective.

Step by Step Answer:

Cambridge International AS And A Level Economics Coursebook

ISBN: 9781107679511

3rd Edition

Authors: Colin Bamford, Susan Grant