The Sopchoppy Motorcycle Company is considering an investment of $600,000 in a new motorcycle. The company expects

Question:

The Sopchoppy Motorcycle Company is considering an investment of $600,000 in a new motorcycle. The company expects to increase sales in each of the next three years by $400,000, while increasing expenses by $200,000 each year. The company expects that it can carve out a niche in the marketplace for this new motorcycle for three years, after which the company intends to cease production on this motorcycle. Assume the equipment is depreciated at the rate of $200,000 each year. Sopchoppy’s tax rate is 40%.

(a)

What is the internal rate of return of this project if the company sells the manufacturing equipment for $200,000 at the end of three years?

(b)

What is the internal rate of return of this project if the company sells the manufacturing equipment for $100,000 at the end of three years?

(c)

What is the internal rate of return of this project if the company sells the manufacturing equipment for $300,000 at the end of three years?

(d)

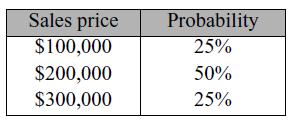

Suppose the following distribution of possible sales prices on the equipment is developed:

What is the expected internal rate of return for Sopchoppy? What is the standard deviation of these possible internal rates of return?LO3

Step by Step Answer: