An oil company is offered a lease of a group of oil wells on which the primary

Question:

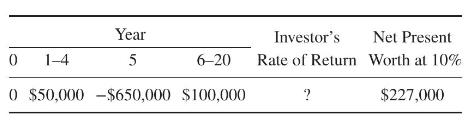

An oil company is offered a lease of a group of oil wells on which the primary reserves are close to exhaustion. The major condition of the purchase is that the oil company must agree to undertake a water-flood project at the end of \(5 \mathrm{yr}\) to make possible secondary recovery. No immediate payment by the oil company is required. The relevant cash flows have been estimated as follows:

Should the lease-and-flood arrangement be accepted? How should this proposal be presented to the company board of directors, who understand and make it a policy to evaluate by the investor's rate of return?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Product And Process Design Principles Synthesis Analysis And Evaluation

ISBN: 9781119355243

4th Edition

Authors: Warren D. Seider, Daniel R. Lewin, J. D. Seader, Soemantri Widagdo, Rafiqul Gani, Ka Ming Ng

Question Posted: