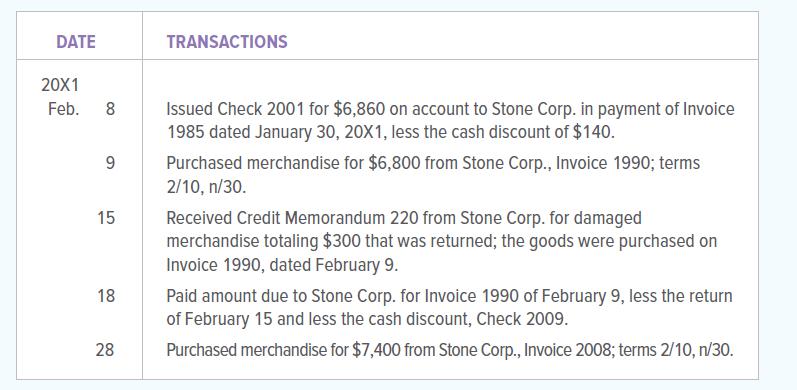

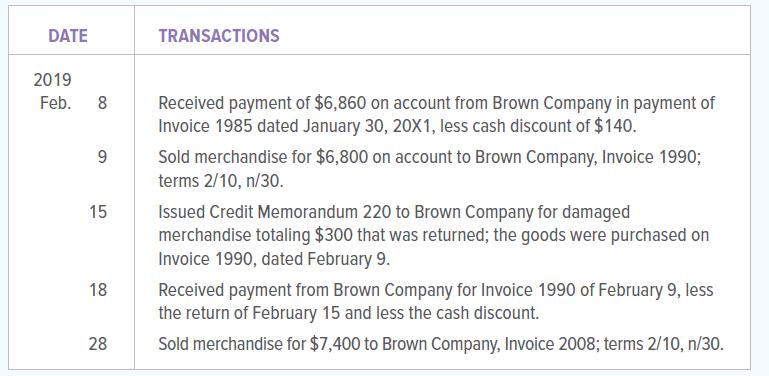

Brown Company (buyer) and Stone Corp. (seller) engaged in the following transactions during February 20X1: Brown Company

Question:

Brown Company (buyer) and Stone Corp. (seller) engaged in the following transactions during February 20X1:

Brown Company

Stone Corp.

INSTRUCTIONS

1. Open the accounts payable ledger account and accounts receivable ledger account indicated below for both Brown Company and Stone Corp. Enter the balances as of February 1, 20X1.

2. Journalize the transactions above in a general journal for both Brown Company and Stone Corp. Begin the journals for both companies with page 12.

3. Post the transactions to the appropriate accounts in the general ledger and the accounts payable subsidiary ledger for Brown Company.

4. Post the transactions to the appropriate accounts in the general ledger and the accounts receivable subsidiary ledger for Stone Corp.

GENERAL LEDGER ACCOUNTS—BROWN COMPANY

201 Accounts Payable, $7,000 Cr.

ACCOUNTS PAYABLE LEDGER ACCOUNT—BROWN COMPANY

Stone Corp., $7,000

GENERAL LEDGER ACCOUNTS—STONE CORP.

111 Accounts Receivable, $7,000 Dr.

ACCOUNTS RECEIVABLE LEDGER ACCOUNT—STONE CORP.

Brown Company, $7,000

Analyze:

What is the balance of the accounts payable for Stone Corp. in the Brown Company accounts payable subsidiary ledger? What is the balance of the accounts receivable for Brown Company in the Stone Corp. accounts receivable subsidiary ledger?

Step by Step Answer:

College Accounting A Contemporary Approach

ISBN: 9781260780352

5th Edition

Authors: David Haddock, John Price, Michael Farina