OfficePro Business Supplies began operations October 1, 20X1. The firm sells its merchandise for cash and on

Question:

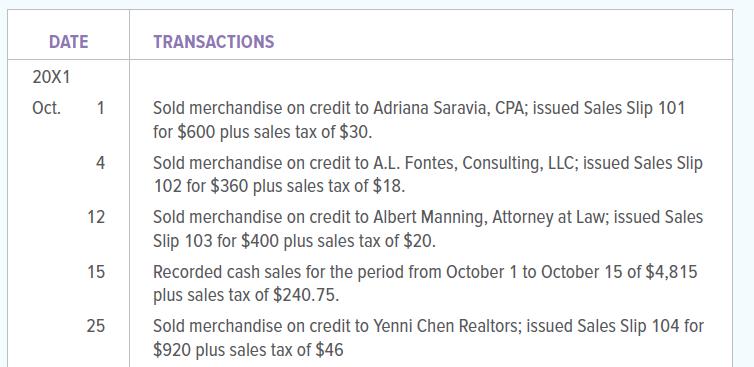

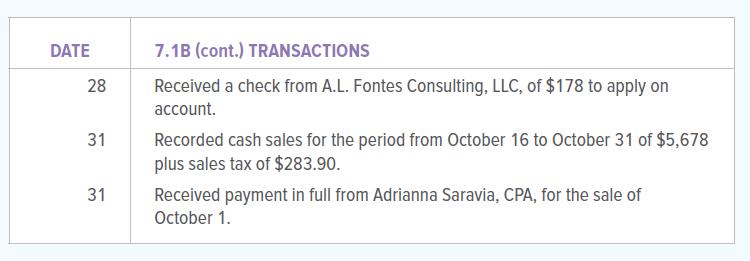

OfficePro Business Supplies began operations October 1, 20X1. The firm sells its merchandise for cash and on open account. Sales are subject to a 5 percent sales tax. During October, OfficePro Business Supplies engaged in the following transactions:

INSTRUCTIONS

1. Open the general ledger accounts indicated below.

2. Record the transactions in a general journal. Use 1 as the journal page number.

3. Post the entries from the general journal to the appropriate general ledger accounts.

GENERAL LEDGER ACCOUNTS

Analyze:

How much is owed for sales taxes collected at October 31?

DATE 20X1 Oct. 1 4 12 15 25 TRANSACTIONS Sold merchandise on credit to Adriana Saravia, CPA; issued Sales Slip 101 for $600 plus sales tax of $30. Sold merchandise on credit to A.L. Fontes, Consulting, LLC; issued Sales Slip 102 for $360 plus sales tax of $18. Sold merchandise on credit to Albert Manning, Attorney at Law; issued Sales Slip 103 for $400 plus sales tax of $20. Recorded cash sales for the period from October 1 to October 15 of $4,815 plus sales tax of $240.75. Sold merchandise on credit to Yenni Chen Realtors; issued Sales Slip 104 for $920 plus sales tax of $46

Step by Step Answer:

2 Recording of transaction in General Journal The journal entries can be posted as follows DATE ACCO...View the full answer

College Accounting A Contemporary Approach

ISBN: 9781260780352

5th Edition

Authors: David Haddock, John Price, Michael Farina

Related Video

A journal entry is an act of keeping or making records of any transactions either economic or non-economic. Transactions are listed in an accounting journal that shows a company\'s debit and credit balances. The journal entry can consist of several recordings, each of which is either a debit or a credit

Students also viewed these Business questions

-

Regal Business Supplies began operations October 1, 2019. The firm sells its merchandise for cash and on open account. Sales are subject to a 5 percent sales tax. During October, Regal Business...

-

Venus Office Supplies began operations October 1, 2016. The firm sells its merchandise for cash and on open account. Sales are subject to a 5 percent sales tax. During October, Venus Office Supplies...

-

The Appliance Store began operations March 1, 2019. The firm sells its merchandise for cash and on open account. Sales are subject to a 6 percent sales tax. During March, The Appliance Store engaged...

-

Solar Energy Corp. has $4 million in earnings with four million shares outstanding. Investment bankers think the stock can justify a P/E ratio of 21. Assume the underwriting spread is 5 percent. What...

-

Describe Johnsons rule.

-

The article "Multimodal Versus Unimodal Instruction in a Complex Learning Environment" (J. of Experimental Educ., 2002: 215-239) described an experiment carried out to compare students' mastery of...

-

Environmental impact study. Some power plants are located near rivers or oceans so that the available water can be used to cool the condensers. Suppose that, as part of an environmental impact study,...

-

Heritage Union has said that 66% of U.S. adults have purchased life insurance. Suppose that for a random sample of 50 adults from a given U.S. city, a researcher finds that only 56% of them have...

-

Jasper Company has 58% of its sales on credit and 42% for cash. All credit sales are collected in full in the first month following the sale. The company budgets sales of $534.000 for April. $544.000...

-

William Gail opened his automobile cleaning service G-Force Auto Detailing, specializing in interior cleaning of automobiles. The end-of-year unadjusted trial balance contained the following accounts...

-

Sports Junction began operations March 1, 20X1. The firm sells its merchandise for cash; on open account; to customers using bank credit cards, such as MasterCard and Visa; and to customers using...

-

Cozy Kitchens began operations March 1, 20X1. The firm sells its merchandise for cash and on open account. Sales are subject to a 6 percent sales tax. The terms for all sales on credit are net 30....

-

Consider a solution made by mixing \(500.0 \mathrm{~mL}\) of 4.0 \(M \mathrm{NH}_{3}\) and \(500.0 \mathrm{~mL}\) of \(0.40 \mathrm{M} \mathrm{AgNO}_{3} . \mathrm{Ag}^{+}\)reacts with...

-

Silver Company makes a product that is very popular as a Mothers Day gift. Thus, peak sales occur in May of each year, as shown in the companys sales budget for the second quarter given below: April...

-

Among the following statements, select the ones which have a positive environmental impact. Choose several answers Minimising the impact of a product on the environment Avoiding the destruction of a...

-

Developing Financial Statements: All organizations, including those in the healthcare industry, need to make money to be profitable and survive. Financial statements, such as balance sheets, profit...

-

The engineers estimated that on average, fuel costs, assuming existing routes and number of flights stay the same, would decrease by almost 18% from an average of 42,000 gallons of jet fuel per...

-

It's the latest Berkeley trend: raising chickens in a backyard co-op coop. (The chickens cluck with delight at that joke.) It turns out that Berkeley chickens have an unusual property: their weight...

-

Evaluate the binomial coefficient. 3.

-

A Firm intends to invest some capital for a period of 15 years; the Firm's Management considers three Options, each consisting of purchasing a machinery of a specific brand, different for each...

-

The following transactions occurred at E Brainerd Inc. during 2022. Use this information to compute the companys net cash flow from investing activities. 1. The company issued 100,000 shares of its...

-

A comparative balance sheet for Stokely, Inc., on December 31, 2022 and 2021, follows. Additional information about the firms financial activities during 2022 is also given below. INSTRUCTIONS...

-

TNCal Company has outstanding $500,000 of its 6 percent bonds payable, dated January 1, 2022, and maturing on January 1, 2042, 20 years later. The corporation is required under the bond contract to...

-

The following information is provided by Garden Gears for a new product it recently introduced: Total unit cost $50 Desired ROI per unit $22 Target selling price $72 How much is Garden Gears'...

-

Solid bank loan P5 million to a borrower on January 1, 2018. The terms of the loan require principal payments of P1 million each year for five years plus interest at 8%. The first principal and...

-

3) Assuming annual sales of $250,000 and a 50% gross (contribution) margin, calculate the following a. Average collection period if ending receivables total $45,000 b. Ending days-on-hand of...

Study smarter with the SolutionInn App