On June 1, 20X1, William Tsang established his own consulting firm. Selected transactions for the first few

Question:

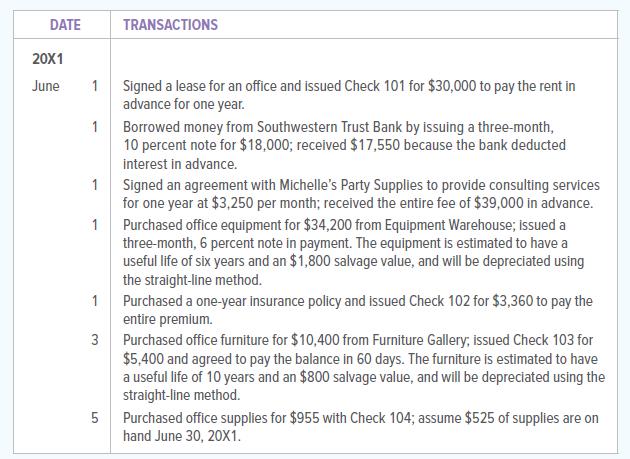

On June 1, 20X1, William Tsang established his own consulting firm. Selected transactions for the first few days of June follow.

1. Record the transactions on page 1 of the general journal. Omit descriptions. Assume that the firm initially records prepaid expenses as assets and unearned income as a liability.

2. Record the adjusting journal entries that must be made on June 30, 20X1, on page 2 of the general journal. Omit descriptions.

Analyze:

At the end of calendar year 20X1, how much of the rent paid on June 1 will have been charged to expense?

DATE 20X1 June 1 Signed a lease for an office and issued Check 101 for $30,000 to pay the rent in advance for one year. 1 1 1 1 3 TRANSACTIONS 5 Borrowed money from Southwestern Trust Bank by issuing a three-month, 10 percent note for $18,000; received $17,550 because the bank deducted interest in advance. Signed an agreement with Michelle's Party Supplies to provide consulting services for one year at $3,250 per month; received the entire fee of $39,000 in advance. Purchased office equipment for $34,200 from Equipment Warehouse; issued a three-month, 6 percent note in payment. The equipment is estimated to have a useful life of six years and an $1,800 salvage value, and will be depreciated using the straight-line method. Purchased a one-year insurance policy and issued Check 102 for $3,360 to pay the entire premium. Purchased office furniture for $10,400 from Furniture Gallery, issued Check 103 for $5,400 and agreed to pay the balance in 60 days. The furniture is estimated to have a useful life of 10 years and an $800 salvage value, and will be depreciated using the straight-line method. Purchased office supplies for $955 with Check 104; assume $525 of supplies are on hand June 30, 20X1.

Step by Step Answer:

To determine how much of the rent paid on June 1 will have been charged to expense at the end of ca...View the full answer

College Accounting A Contemporary Approach

ISBN: 9781260780352

5th Edition

Authors: David Haddock, John Price, Michael Farina

Related Video

A journal entry is an act of keeping or making records of any transactions either economic or non-economic. Transactions are listed in an accounting journal that shows a company\'s debit and credit balances. The journal entry can consist of several recordings, each of which is either a debit or a credit

Students also viewed these Business questions

-

Johann Wheldon, owner of Wheldon Stenciling Service, has requested that you prepare from the following balances (a) An income statement for November 201X, (b) A statement of owners equity for...

-

On June 1, 2019, Raquel Ramirez established her own advertising firm. Selected transactions for the first few days of June follow. 1. Record the transactions on page 1 of the general journal. Omit...

-

On July 1,2010, Shawn Smith established his own accounting practice. Selected transactions for the first few days of July follow. Instruction 1. Record the transactions on page 1 of the general...

-

Describe the three cases to consider when determining if a cost allocation is beneficial.

-

Trace through the five steps in the O.B. Mod. model to show how it could be applied to this tardiness problem. Make sure you are specific in identifying the critical performance behaviors and the...

-

What is the reaction of Benton's other vice president to the ERP proposal?

-

(Pension Worksheet) Buhl Corp. sponsors a defined benefit pension plan for its employees. On January 1, 2011, the following balances relate to this plan. Plan assets $480,000 Projected benefit...

-

WAR (We Are Rich) has been in business since 1985. WAR is an accrual method sole proprietorship that deals in the manufacturing and wholesaling of various types of golf equipment. Hack & Hack CPAs...

-

Prepare a 2 0 2 4 US federal income tax return for Amanda and Andrew using the following information: Ages: Andrew: 6 4 ; Amanda: 6 2 ; Homer ( son ) : 1 1 ; Astella ( daughter ) : 1 9 . Amanda paid...

-

This alphabetized adjusted trial balance is for GalaVu Entertainment as of its December 31, 2020, year-end: Debit Credit Accounts payable $ 44,000 Accounts receivable $ 18,700 Accumulated...

-

Healthy Eating Foods Company is a distributor of nutritious snack foods such as granola bars. On December 31, 20X1, the firms general ledger contained the accounts and balances that follow. ACCOUNTS...

-

On July 1, 20X1, Cherie Wang established Cherie Wang Financial Services. Selected transactions for the first few days of July follow. INSTRUCTIONS 1. Record the transactions on page 1 of the general...

-

You are considering refinancing your mortgage. Your current loan is at 7% with 14 years left and was negotiated one year ago with $2,000 closing costs. The new loan would be 5.5% for 15 years with...

-

21. How a degradation process is modeled? 22.Give the homogenity property in Linear Operator 23. Give the relation for degradation model for continuous function 24.which is called the superposition...

-

28. Define Gray-level interpolation 29. What is meant by Noise probability density function? 30. Why the restoration is called as unconstrained restoration? 31. Which is the most frequent method to...

-

34. Give the relation for guassian noise 35. Give the relation for rayleigh noise 36. Give the relation for Gamma noise 37. Give the relation for Exponential noise 38. Give the relation for Uniform...

-

41. What is pseudo inverse filter? 42. What is meant by least mean square filter? 43. Give the difference between Enhancement and Restoration PART-B 1. Discuss different mean filters

-

1.Discuss different mean filters 2. Draw the degradation model and explain. 3.Write short notes on Median Filters

-

Determine whether the following series converge or diverge. In the case of convergence, state whether the convergence is conditional or absolute. (-1)* k=2 k- - 1 00 .2

-

Whats the difference between an ordinary annuity and an annuity due? What type of annuity is shown below? How would you change the time line to show the other type of annuity?

-

In 2015, CSX Corporation, which operates under the name Surface Transportation, reported operating expenses of $8,227 million. A partial list of the company's operating expenses follows. CSX...

-

In 2015, CSX Corporation, which operates under the name Surface Transportation, reported operating expenses of $8,227 million. A partial list of the company's operating expenses follows. CSX...

-

1. Use the final balances of the customer accounts after completing Exercise 7.9 to prepare a schedule of accounts receivable for Calderone Company at January 31, 2019. 2. Should the total of your...

-

Practicum Co. pad $1.2 million for an 80% interest in the common stock of Sarong Co. Practicum had no previous equity interest in Sarong. On the acquisition date, Sarong's identifiable net assets had...

-

On Dec 31 2020, Bernice Melson, a partner in ABC Communications, had an ending capital balance of $49,000. Her share of the partnership's profit was $18,000; she made investments of $12,000 and had...

-

Q2R. on account for each depreciable asset. During 2024, Jane VIIS nsactions.) i More Info Apr. 1 Purchased office equipment. 5111,000. Paid 581,000 cash and financed the remainder Jan. 1 with a note...

Study smarter with the SolutionInn App