Programs Plus is a retail firm that sells computer programs for home and business use. Programs Plus

Question:

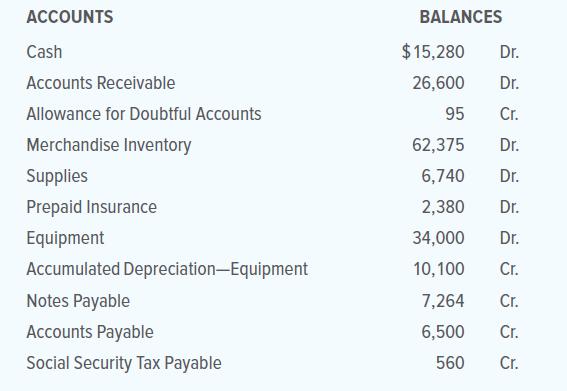

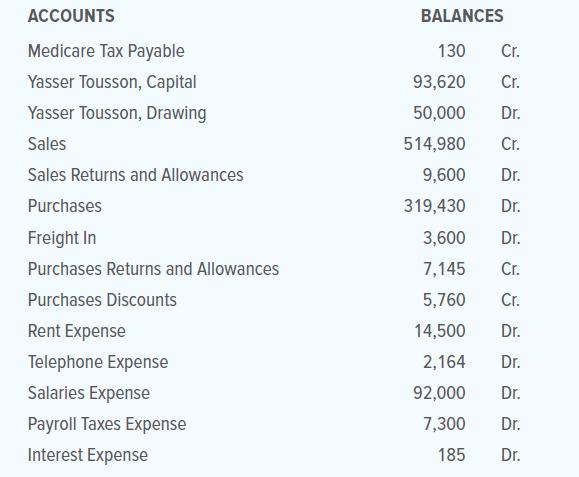

Programs Plus is a retail firm that sells computer programs for home and business use. Programs Plus operates in a state with no sales tax. On December 31, 20X1, its general ledger contained the accounts and balances shown below:

ACCOUNTS (CONT.)

The following accounts had zero balances:

Salaries Payable

Interest Payable

Income Summary

Supplies Expense

Insurance Expense

Depreciation Expense—Equipment

Uncollectible Accounts Expense

The data needed for the adjustments on December 31 are as follows:

a.–b. Ending merchandise inventory, $67,850.

c. Uncollectible accounts, 0.5 percent of net credit sales of $245,000.

d. Supplies on hand December 31, $1,020.

e. Expired insurance, $1,190.

f. Depreciation Expense—Equipment, $5,600.

g. Accrued interest expense on notes payable, $325.

h. Accrued salaries, $2,100.

i. Social Security Tax Payable (6.2 percent) and Medicare Tax Payable (1.45 percent) of accrued salaries.

INSTRUCTIONS

1. Prepare a worksheet for the year ended December 31, 20X1.

2. Prepare a classified income statement. The firm does not divide its operating expenses into selling and administrative expenses.

3. Prepare a statement of owner’s equity. No additional investments were made during the period.

4. Prepare a classified balance sheet. All notes payable are due within one year.

5. Journalize the adjusting entries. Use 25 as the first journal page number.

6. Journalize the closing entries.

7. Journalize the reversing entries.

Analyze:

By what percentage did the owner’s capital account change in the period from January 1, 20X1, to December 31, 20X1?

Step by Step Answer:

College Accounting A Contemporary Approach

ISBN: 9781260780352

5th Edition

Authors: David Haddock, John Price, Michael Farina