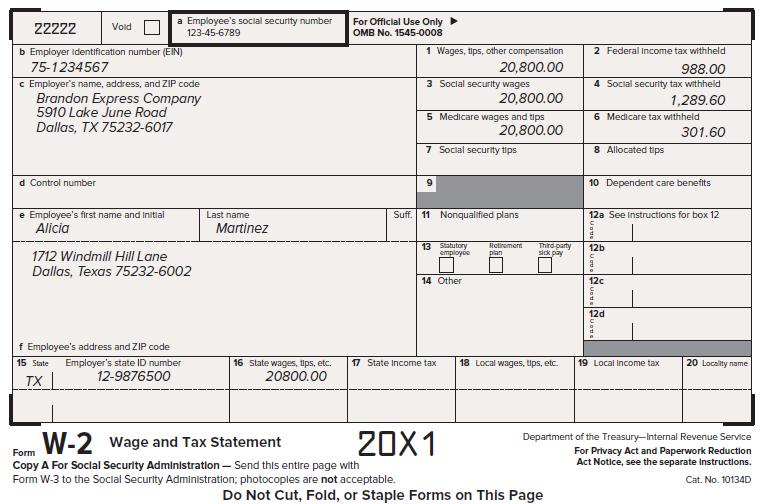

The Form W-2 is used to report all but the following: Data From in W-2 a. Gross

Question:

The Form W-2 is used to report all but the following:

Data From in W-2

a. Gross earnings for the year.

b. Total federal income tax withheld from employee earnings for the year.

c. Total payroll taxes the company paid this year.

d. Total Medicare tax withheld from employee earnings for the year.

Transcribed Image Text:

Vold d Control number 22222 b Employer identification number (EIN) 75-1234567 c Employer's name, address, and ZIP code Brandon Express Company 5910 Lake June Road Dallas, TX 75232-6017 a Employee's social security number 123-45-6789 e Employee's first name and initial Alicia 1712 Windmill Hill Lane Dallas, Texas 75232-6002 f Employee's address and ZIP code 15 State Employer's state ID number 12-9876500 TX Last name Martinez 16 State wages, tips, etc. 20800.00 For Official Use Only OMB No. 1545-0008 1 Wages, tips, other compensation 20,800.00 3 Social security wages W-2 Wage and Tax Statement Form Copy A For Social Security Administration - Send this entire page with Form W-3 to the Social Security Administration; photocoples are not acceptable. 5 Medicare wages and tips 9 7 Social security tips Suff. 11 Nonqualified plans 13 Statutory employe 20,800.00 14 Other 17 State Income tax 20X1 20,800.00 Retirement plan Third-party sick pay 18 Local wages, tips, etc. 2 Federal Income tax withheld 988.00 4 Social security tax withheld 1,289.60 Do Not Cut, Fold, or Staple Forms on This Page 6 Medicare tax withheld 8 Allocated tips 10 Dependent care benefits 12a See Instructions for box 12 12b a 12c 301.60 12d 19 Local income tax 20 Locality name Department of the Trea y-Internal Revenue Service For Privacy Act and Paperwork Reduction Act Notice, see the separate Instructions. Cat. No. 10134D

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 81% (11 reviews)

c Total payroll taxes the company paid this year The Form W2 is used ...View the full answer

Answered By

Kenneth Mutia

I have a B.S. in Statistics from the Jomo Kenyatta University of Agriculture and technology. I have been an academic tutor for over 3 years. I have a passion for helping students reach their full potential and am dedicated to helping them succeed. I am patient and adaptable, and I have experience working with students of all ages and abilities, from elementary school to college in their various fields. I have a wide scope of diverse tutoring experience in several courses of study with significant success as a tutor.

0.00

0 Reviews

10+ Question Solved

Related Book For

College Accounting A Contemporary Approach

ISBN: 9781260780352

5th Edition

Authors: David Haddock, John Price, Michael Farina

Question Posted:

Students also viewed these Business questions

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-4. Ivan and Irene paid the following in 2012 (all by check or can otherwise be...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-6. On December 12, Irene purchased the building where her store is located. She paid...

-

Calculate the CGT payable in relation to each of the following disposals, assuming in each case that the annual exemption is fully utilised against other gains, that there are no allowable losses and...

-

What is organizational commitment? What three components have emerged to help better explain the complexities of commitment? Why may an understanding of organizational commitment be especially...

-

ABC is a partnership owned by Ales, Baker, and Chaplin, who share profits and losses in the ratio of 2:1:1, respectively. The account balances of the partnership at June 30, 2016, follow:...

-

P 5-3 Computations (parent buys from one subsidiary and sells to the other) Pam Company owns controlling interests in Sun and Toy Corporations, having acquired an 80 percent interest in Sun in 2016,...

-

Emily Pemberton is an IS project manager facing a difficult situation. Emily works for the First Trust Bank, which has recently acquired the City National Bank. Prior to the acquisition, First Trust...

-

For ratios, 47.87,0.01,0.01,0.33,0.31, could you help me check? Besides, could you give me some comments on profitability, liquidity and financial position and strategies(marketing and advertising...

-

Vista City hospital plans the short-stay assignment of surplus beds (those that are not already occupied) 4 days in advance. During the 4-day planning period about 30, 25, and 20 patients will...

-

Who pays the federal unemployment tax and the state unemployment tax? a. Congress appropriates money to pay these taxes. b. State governments appropriate money to pay these taxes. c. Employees pay...

-

In each of the following independent situations, decide whether the business organization should treat the person being paid as an employee and should withhold social security, Medicare, and employee...

-

What amount of CAE's March 31, 2012 accounts receivable are not overdue? What amount is overdue three months or less? What amount is overdue more than three months? Compare the percentages of overdue...

-

Use the following information for questions 1 and 2. Caterpillar Financial Services Corp. (a subsidiary of Caterpillar) and Sterling Construction sign a lease agreement dated January 1, 2020, that...

-

Identifying Binomial Distributions. Determine whether the given procedure results in a binomial distribution or a distribution that can be treated as binomial (by applying the 5% guideline for...

-

Case 6: TOMS Shoes in 2016: An Ongoing Dedication to Social Responsibility, by Margaret A. Peteraf, Sean Zhand, and Meghan L. Cooney (page C-57) Read the case and then respond to the case questions...

-

Quatro Co. issues bonds dated January 1, 2019, with a par value of $740,000. The bonds' annual contract rate is 13%, and interest is paid semiannually on June 30 and December 31. The bonds mature in...

-

Wildcat Mining wants to know the appropriate discount rate to use in their capital budgeting decision making process. Based on the following data, what is the weighted average cost of capital the CFO...

-

Consider the following velocity functions. In each case, complete the sentence: The same distance could have been traveled over the given time period at a constant velocity of ________. v(t) = 1 - t...

-

Integration is a vital concept when applied in one?s life. Integrating your life means making ideal choices. Perfect choices on the other go in line with quality decisions. Quality decisions lead to...

-

1. Open the general ledger accounts and accounts payable ledger accounts indicated below. Enter the balances as of June 1, 2019. 2. Post the transactions in Problem 8.4A to the appropriate accounts...

-

Bowden Company (buyer) and Song, Inc. (seller), engaged in the following transactions during January 2019: Bowden Company DATE TRANSACTIONS 2019 Jan. 8 Issued Check 2101 for $2,940 on account to...

-

The following transactions took place at Fine Fashions Outlet during July 2019. Fine Fashions Outlet uses a perpetual inventory system. Record the transactions in a general journal. Use 8 as the page...

-

Green Lawn Company sells garden supplies. Management is planning its cash needs for the second quarter. The following information has been assembled to assist in preparing a cash budget for the...

-

eBook Question Content Area Comparison of Methods of Allocation Duweynie Pottery, Inc., is divided into two operating divisions: Pottery and Retail. The company allocates Power and General Factory...

-

TYBALT CONSTRUCTION Income Statement For Year Ended December 31 TYBALT CONSTRUCTION Income Statement For Year Ended December 31

Study smarter with the SolutionInn App