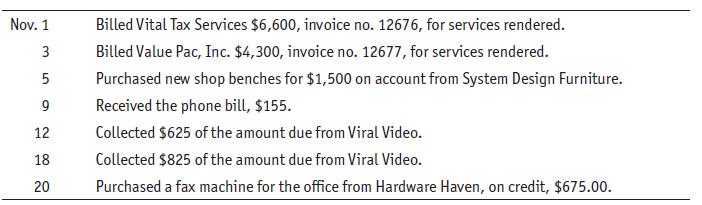

During the month of November, the following transactions occurred. Assignment 1. Record the following transactions in the

Question:

During the month of November, the following transactions occurred.

Assignment

1. Record the following transactions in the general journal and post them to the general ledger.

2. Prepare a trial balance as of November 30, 202X.

Transcribed Image Text:

Nov. 1 3 5 9 12 18 20 Billed Vital Tax Services $6,600, invoice no. 12676, for services rendered. Billed Value Pac, Inc. $4,300, invoice no. 12677, for services rendered. Purchased new shop benches for $1,500 on account from System Design Furniture. Received the phone bill, $155. Collected $625 of the amount due from Viral Video. Collected $825 of the amount due from Viral Video. Purchased a fax machine for the office from Hardware Haven, on credit, $675.00.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (6 reviews)

Date Nov 1 3 5 9 12 Account Titles and Description Accounts Receivable Vital Tax Services Service Revenue Accounts Receivable Value Pac Inc Service Revenue GENERAL JOURNAL Computer Shop Equipment Acco...View the full answer

Answered By

Bhartendu Goyal

Professional, Experienced, and Expert tutor who will provide speedy and to-the-point solutions. I have been teaching students for 5 years now in different subjects and it's truly been one of the most rewarding experiences of my life. I have also done one-to-one tutoring with 100+ students and help them achieve great subject knowledge. I have expertise in computer subjects like C++, C, Java, and Python programming and other computer Science related fields. Many of my student's parents message me that your lessons improved their children's grades and this is the best only thing you want as a tea...

3.00+

2+ Reviews

10+ Question Solved

Related Book For

College Accounting A Practical Approach Chapters 1-25

ISBN: 9780137504282

15th Edition

Authors: Jeffrey Slater, Mike Deschamps

Question Posted:

Students also viewed these Business questions

-

During the month of November the following transactions occurred. Assignment 1. Record the following transactions in the general journal and post them to the general ledger. 2. Prepare a trial...

-

Start of Payroll Project 7-3a October 9, 20-- No. 1 The first payroll in October covered the two workweeks that ended on September 26 and October 3. This payroll transaction has been entered for you...

-

General Ledger (GL) Assignments expose students to general ledger software similar to that in practice. GL is part of Connect, and GL assignments are auto-gradable and have algorithmic options. For...

-

Mexico discovers huge reserves of oil and starts exporting oil to the United States. Describe how this would affect the following. a. The nominal pesoU.S. dollar exchange rate. b. Mexican exports to...

-

Assume the following. Deli Company purchased a parcel of land on January 1, 2008, for $600,000. It constructed a building on the land at a cost of $3,000,000. The building was occupied on January 1,...

-

If a VLIW form of an existing processor were to be produced, why would the source code have to be recompiled?

-

1. Define a granular perspective for performance measurement. Why is this crucial for performance measurement at large companies?

-

Read the paragraph in Appendix A, note 1, under item 3.RATIONALIZATION CHARGES. The paragraph describes a series of business decisions made by Home Depot to close some of its stores, including 15...

-

A debtor, P. Smith, was declared insolvent. His insolvent estate paid R600 which represented 40% of his debt. The balance of his account must now be written off.

-

Compute the net pay for each employee using the federal income tax withholding table in Figure 7.3. Assume that FICA Social Security tax is 6.2% on a wage base limit of $142,800, FICA Medicare is...

-

a. Calculate the total wages earned for each employee assuming an overtime rate of 1.5 over 40 hours. b. Calculate the total biweekly earnings of these newly hired salaried employees. Employee Robert...

-

Light is incident normally on a slab of glass with an index of refraction n = 1.5. Reflection occurs at both surfaces of the slab. About what percentage of the incident light energy is transmitted by...

-

The following information is available for two different types of businesses for the 2011 accounting period. Dixon Consulting is a service business that provides consulting services to small...

-

Marino Basket Company had a \(\$ 6,200\) beginning balance in its Merchandise Inventory account. The following information regarding Marino's purchases and sales of inventory during its 2011...

-

On March 6, 2011, Bob's Imports purchased merchandise from Watches Inc. with a list price of \(\$ 31,000\), terms \(2 / 10, n / 45\). On March 10, Bob's returned merchandise to Watches Inc. for...

-

The following events apply to Tops Gift Shop for 2012, its first year of operation: 1. Acquired \(\$ 45,000\) cash from the issue of common stock. 2. Issued common stock to Kayla Taylor, one of the...

-

Indicate whether each of the following costs is a product cost or a period (selling and administrative) cost. a. Transportation-in. b. Insurance on the office building. c. Office supplies. d. Costs...

-

What is a bank's gap, and what does it attempt to determine? Interpret a negative gap. What are some limitations of measuring a bank's gap?

-

Global.asax is used for: a. declare application variables O b. all other answers are wrong O c. declare global variables O d. handle application events

-

On December 31, 2012, $290 of salaries has been accrued. (Salaries before the accrued amount totaled $28,000.) The next payroll to be paid will be on February 3, 2013, for $5,700. Please do the...

-

From the following accounts, prepare a cost of goods sold section in proper form: Merchandise Inventory, 12/31/1X, $8,990; Purchases Discount, $850; Merchandise Inventory, 12/01/1X, $4,200;...

-

Give the category, the classification, and the report(s) on which each of the following appears (for example: Cashasset, current asset, balance sheet): a. Wages Payable b. Accounts Payable c. Notes...

-

Which of the following programs covers custodial care? A HMOs B Medicare Part B C PPOs D Medicare Part A E Medicaid

-

uppose a taxpayer has exhausted his lifetime exclusion amount and has $14 million. a. Assuming a flat 40% gift tax rate, what is the maximum amount a taxpayer can transfer to her daughter (and still...

-

Physical Units Method, Relative Sales Value Method Farleigh Petroleum, Inc., is a small company that acquires high - grade crude oil from low - volume production wells owned by individuals and small...

Study smarter with the SolutionInn App