Journalize the adjusting entry on December 31, 2021, for Bad Debts Expense, which is estimated to be

Question:

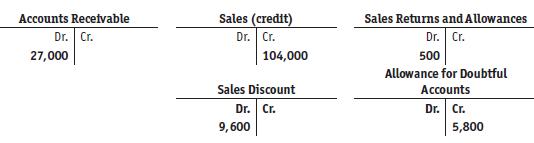

Journalize the adjusting entry on December 31, 2021, for Bad Debts Expense, which is estimated to be 4% of net credit sales. The income statement approach is used. The following information is given:

Transcribed Image Text:

Accounts Receivable Dr. Cr. 27,000 Sales (credit) Dr. Cr. 104,000 Sales Discount Dr. Cr. 9,600 Sales Returns and Allowances Dr. Cr. 500 Allowance for Doubtful Accounts Dr. Cr. 5,800

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (4 reviews)

The adjusting entry for Bad Debts Expense can be calculated using the incom...View the full answer

Answered By

User l_917591

As a Business Management graduate from Moi University, I had the opportunity to work as a tutor for undergraduate students in the same field. This experience allowed me to apply the theoretical knowledge I had gained in a practical setting, while also honing my teaching and communication skills.

As a tutor, I was responsible for conducting tutorial sessions, grading assignments and exams, and providing feedback and support to my students. I also assisted with the preparation of course materials and collaborated with other tutors and professors to ensure consistency in teaching and assessment.

0.00

0 Reviews

10+ Question Solved

Related Book For

College Accounting A Practical Approach Chapters 1-25

ISBN: 9780137504282

15th Edition

Authors: Jeffrey Slater, Mike Deschamps

Question Posted:

Students also viewed these Business questions

-

Journalize the adjusting entry on December 31, 2015, for Bad Debts Expense, which is estimated to be 9% of net credit sales. The income statement approach is used. The following information is given:...

-

Journalize the adjusting entry on December 31, 2015, for Bad Debts Expense, which is estimated to be 3% of net credit sales. The income statement approach is used. The following information is given:...

-

Journalize the adjusting entry on December 31, 2012, for Bad Debts Expense, which is estimated to be 5% of net sales. The income statement approach is used. The following information isgiven: Sales...

-

The root cause of underdevelopment and environmental degradation is the overdevelopment of a handful of rich nations. Discuss.

-

The following transactions relate to Direct Towing Service. Assume the transactions for the purchase of the wrecker and any capital improvements occur on January 1 of each year. 2013 1. Acquired...

-

Given the following data (in the increasing order) for the attribute age: 13, 15, 16, 16, 19, 20, 20, 21, 22, 22, 25, 25, 25, 25, 30, 33, 33, 35, 35, 35, 35, 36, 40, 45, 46, 52, 70. (a) Use smoothing...

-

5. What are some of the more common nonoperating items and one-time charges that should be excluded from operating expenses?

-

On May 1, B. Bangle opened Self- Wash Laundry. His accountant listed the following chart of accounts: Cash Supplies Prepaid Insurance Equipment Furniture and Fixtures Accounts Payable B. Bangle,...

-

Table 1: Pepita Disco Performance, 2011 (UYU in millions) Units sold 100 million units Revenue 200 Variable costs Materials 30 Direct labor(manufacturing,sales) 40 Opearational...

-

From the following, journalize the (a) Sale of assets and (b) Distribution of loss or gain from liquidation realization. Given: Partners agreed to share losses or gains in a 3:3:4 ratio and sold...

-

Given the information presented in Figure 13.12, do the following: a. Prepare on December 31, 2021, the adjusting journal entry for Bad Debts Expense. Balances: Cash, $28,000; Accounts Receivable,...

-

Solve using the elimination method. Also determine whether the system is consistent or inconsistent and whether the equations are dependent or independent. Use a graphing calculator to check your...

-

Show that the scalar $K$, which, according to Eq. (5.366), is constructed from the extrinsic curvature as $K=g^{\mu v} K_{\mu u}$, is equal to the covariant divergence of the normal vector field,...

-

An aircraft is in flight, and its \(\mathrm{TAS}=220 \mathrm{~m} / \mathrm{s}\). The ambient temperature is \(T=253 \mathrm{~K}\). What is the stagnation temperature on its leading edge?

-

A diver's watch resists an absolute pressure of 5.5 bar. At an ocean having density of \(1025 \mathrm{~kg} / \mathrm{m}^{3}\) and exposing an atmospheric pressure of \(1 \mathrm{bar}\), what depth...

-

Estimate TAS if an aircraft is at ALT \(=9500 \mathrm{~m}\) and its Mach number \(M\) is 0.5 .

-

The Mach number of an aircraft is \(M=0.9\), and the local temperature is \(T=-10^{\circ} \mathrm{C}\). What is its airspeed?

-

Explain how credit union exposure to liquidity risk differs from that of other financial institutions. Explain why credit unions are more insulated from interest rate risk than some other financial...

-

[a] Two foam blocks, each with a charge of 19 micro coulombs (1 C = 10-6 C), are both held in place 19 cm apart in the east-west direction. A foam ball with a charge 49 C is placed 55 cm north of the...

-

From the following, prepare a chart of accounts. Apple iPad ................................................ Legal Fees Earned Salary Expense ........................................... L. Jonas,...

-

Record the following transaction in the transaction analysis chart: Sue Prazier bought a new piece of computer equipment for $22,000, paying $5,000 down and charging the rest.

-

From the following trial balance of Helm's Cleaners in Figure 2.6, prepare the following for May: 1. Income statement 2. Statement of owner's equity 3. Balance sheet HELM'S CLEANERS TRIAL BALANCE MAY...

-

Create a Data Table to depict the future value when you vary the interest rate and the investment amount. Use the following assumptions: Interest Rates: Investment Amounts:-10.0% $10,000.00 -8.0%...

-

Isaac earns a base salary of $1250 per month and a graduated commission of 0.4% on the first $100,000 of sales, and 0.5% on sales over $100,000. Last month, Isaac's gross salary was $2025. What were...

-

Calculate the price, including both GST and PST, that an individual will pay for a car sold for $26,995.00 in Manitoba. (Assume GST = 5% and PST = 8%) a$29,154.60 b$30,234.40 c$30,504.35 d$28,334.75...

Study smarter with the SolutionInn App