On February 6, 202X, Anthony Pastore made the journal entry in Figure 3.33 to record the purchase

Question:

On February 6, 202X, Anthony Pastore made the journal entry in Figure 3.33 to record the purchase on account of office equipment priced at $1,200. This journal entry had not yet been posted when the error was discovered. Make the appropriate correction.

Transcribed Image Text:

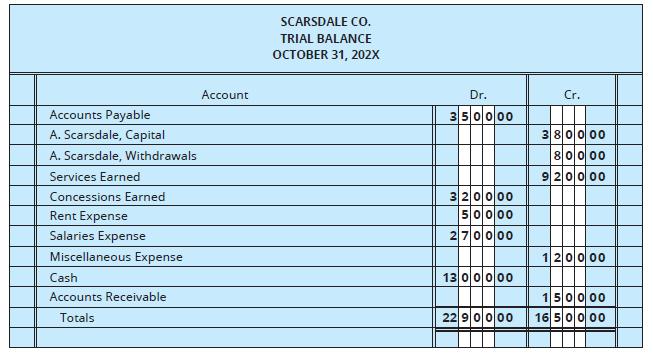

Accounts Payable A. Scarsdale, Capital A. Scarsdale, Withdrawals Services Earned Concessions Earned Rent Expense Salaries Expense Miscellaneous Expense Cash Accounts Receivable Totals Account SCARSDALE CO. TRIAL BALANCE OCTOBER 31, 202X Dr. 350000 320000 50000 270000 13 0 0 0 00 229 0 0 00 Cr. 380000 80000 9 20000 120000 150000 1650000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (6 reviews)

To correct the error in the journal entry made by Anthony Pastore for the purchase of office equipme...View the full answer

Answered By

Chandrasekhar Karri

I have tutored students in accounting at the high school and college levels. I have developed strong teaching methods, which allow me to effectively explain complex accounting concepts to students. Additionally, I am committed to helping students reach their academic goals and providing them with the necessary tools to succeed.

0.00

0 Reviews

10+ Question Solved

Related Book For

College Accounting A Practical Approach Chapters 1-25

ISBN: 9780137504282

15th Edition

Authors: Jeffrey Slater, Mike Deschamps

Question Posted:

Students also viewed these Business questions

-

On February 6, 201X, Mark Sullivan made the journal entry in Figure 3.33 to record the purchase on account of office equipment priced at $1,200. This journal entry had not yet been posted when the...

-

On February 6, 201X, Morris Sanford made the journal entry in Figure 3.36 to record the purchase on account of office equipment priced at $1,000. This journal entry had not yet been posted when the...

-

On February 6, 201X, Morris Sanford made the journal entry in Figure 3.36 to record the purchase on account of office equipment priced at $1,000. This journal entry had not yet been posted when the...

-

A vertical force P is applied to the ends of cord AB of length a and spring AC. If the spring has an unstretched length δ, determine the angle θ for equilibrium. Given: P = 10 lb δ...

-

The following accounts, balances, and other financial information are drawn from the records of Vong Company for the year 2013: The Cash account revealed the following cash flows: Received cash from...

-

Use estimation to select the best response in Problems 5-14. Do not calculate. What is a reasonable monthly income when you retire? B A. \(\$ 300\) B. \(\$ 10,000\) C. \(\$ 1,000,000\) D. impossible...

-

10. For Figure 6, verify the following: a. The S&R index price at which the call option diagram intersects the x-axis is $1095.68. b. The S&R index price at which the call option and forward contract...

-

The following information is available for Zoe's Activewear Inc. for three recent fiscal years. Instructions (a) Calculate the inventory turnover, days in inventory, and gross profit rate for 2017...

-

Question 9 Not yet answered Marked out of 2.00 P Flag question IF Sales is OMR 24,000, Variable cost is OMR 14 and selling price 16 and Fixed cost is OMR 8,000. The desired profit will be: a....

-

The chart of accounts for Kims Tree Trimming Service is as follows: Kims Tree Trimming Service completed the following transactions during the month of October: A. Sam Kim invested $30,000 in the...

-

Update the trial balance for Josefinas Landscaping Service (Figure 4.22) for December 31, 202X. Adjustment Data to Update the Trial Balance A. Rent expired, $750. B. Landscaping supplies on hand...

-

Identify three types of transactions that result in a change in a parent companys ownership interest in its subsidiary. LO3

-

In Exercises 29 and 30, find the probabilities and indicate when the "5% guideline for cumbersome calculations" is used. 29. Medical Helicopters In a study of helicopter usage and patient survival,...

-

Introduction to Internetworking Project 1: Ctrl-Alt-Del Inc. INTRODUCTION You have accepted a contract to participate in the design of the network infrastructure of a company called Ctrl-Alt-Del Inc....

-

Construct Arguments Tell whether each statement is always true, sometimes true, or never true. Explain. a. An integer is a whole number. b. A natural number is a rational number. c. An irrational...

-

Please answer the following Questions : 1. Who are the competitors for Whole Foods? 2. Do you consider traditional supermarkets to be competitors for natural and organic supermarkets? 3. How would...

-

LNC Corp is trying to determine the effect of its inventory turnover ratio and DSO on its cash conversion. Credit sales in 2016 is $101,000, cost of goods sold will be 70% of sales and it earned a...

-

a. At the present time, the price-earnings (PE) ratio (stock price per share divided by earnings per share) of other firms in Carson's industry is relatively low but should rise in the future. Why...

-

Players A, B, and C toss a fair coin in order. The first to throw a head wins. What are their respective chances of winning?

-

Calculate the total wages earned (assume an overtime rate of time and a half over 40 hours). Employee ____________ Hourly Rate _________No. of Hours Worked Adam Williams ..................$17...

-

Ben Stein, single, claiming one exemption, has cumulative earnings before this biweekly pay period of $116,200. If he is paid $1,980 this period, what will his deductions be for FIT and FICA (OASDI...

-

From Exercise 2, calculate Ben's net pay. The state income tax rate is 5%, and health insurance is $35. In Exercise 2 Ben Stein, single, claiming one exemption, has cumulative earnings before this...

-

Saly paid $52,000 a year paid on a weekly basis. last pay she had $250 withheld in Income Tax, $48.97 for CPP and $15.80 for EI. an additional $and 25.00 in tax are deducted each pay. She allowed to...

-

Required information [The following information applies to the questions displayed below.] Dain's Diamond Bit Drilling purchased the following assets this year. Asset Drill bits (5-year) Drill bits...

-

Which of the following partnership items are not included in the self-employment income calculation? Ordinary income. Section 179 expense. Guaranteed payments. Gain on the sale of partnership...

Study smarter with the SolutionInn App