The following transactions occurred in March and were related to the general journal and petty cash fund

Question:

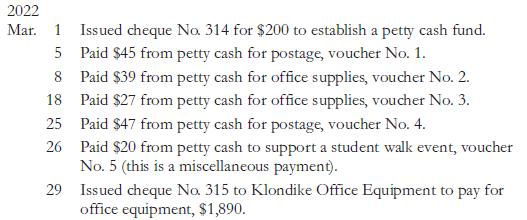

The following transactions occurred in March and were related to the general journal and petty cash fund of Samuel & Co. of St. John’s:

The chart of accounts includes Cash, 100; Petty Cash, 105; Office Equipment, 170; Postage Expense, 645; Office Supplies Expense, 640; Miscellaneous Expense, 630.

Required

1. Record the appropriate entries in the general journal and the auxiliary petty cash record as needed.

2. Be sure to replenish the petty cash fund on March 31 (cheque No. 316).

2022 Mar. 1 Issued cheque No. 314 for $200 to establish a petty cash fund. 5 8 18 25 26 29 Paid $45 from petty cash for postage, voucher No. 1. Paid $39 from petty cash for office supplies, voucher No. 2. Paid $27 from petty cash for office supplies, voucher No. 3. Paid $47 from petty cash for postage, voucher No. 4. Paid $20 from petty cash to support a student walk event, voucher No. 5 (this is a miscellaneous payment). Issued cheque No. 315 to Klondike Office Equipment to pay for office equipment, $1,890.

Step by Step Answer:

Date 2022 Mar 1 Petty Cash Cash To establish petty cash fund Chq 314 29 31 SAMUEL CO GENER...View the full answer

College Accounting A Practical Approach

ISBN: 9780135222416

14th Canadian Edition

Authors: Jeffrey Slater, Debra Good

Related Video

A journal entry is an act of keeping or making records of any transactions either economic or non-economic. Transactions are listed in an accounting journal that shows a company\'s debit and credit balances. The journal entry can consist of several recordings, each of which is either a debit or a credit

Students also viewed these Business questions

-

The following transactions occurred in March and were related to the general journal and petty cash fund of Samuel & Co. of St. Johns. The chart of accounts includes Cash, 100; Petty Cash, 105;...

-

The following transactions occurred in March and were related to the general journal and petty cash fund of Samuel & Co. of St. Johns. 2019 Mar. 1 Issued cheque No. 314 for $200 to establish a petty...

-

The following transactions occurred in April and were related to the general journal and petty cash fund of Ricks Deli of Regina: The chart of accounts includes Cash, 100; Petty Cash, 120; Office...

-

A woman is 5'6" and 150 lbs. pre-pregnancy. Calculate the healthy weight range (lowest to highest) you expect to see just prior to delivery. Include all math to show how you found the answer. A woman...

-

A 0.250-kg ball is dropped from a height of 10.0 cm onto a spring, as illustrated in Fig. 13.24. If the spring has a spring constant of 60.0 N/m, (a) What distance will the spring be compressed?...

-

Differentiate between the admission of a new partner through assignment of an interest and through investment in the partnership. LO2

-

When an American sales manager visits Malaysia, the business meetings he attends are conducted in English. Even so, he finds it difficult to follow the discussion due to: Frequent mispronunciations....

-

The bookkeeper for Brooks Equipment Repair made a number of errors in journalizing and posting, as described below. 1. A credit posting of $450 to Accounts Receivable was omitted. 2. A debit posting...

-

What is the formula for price elasticity of demand? What the one for the income elasticity of demand? Finally, what is the cross price elasticity of demand? Use the following notation for the demand...

-

Assume the following data for Quality Care Dry Cleaning for the year ended December 31. Gross earnings $355,600.00 All employees salaries are greater than $7,000 in the fi rst quarter of employment...

-

From the following, construct a bank reconciliation with heading for Woody Co. as of May 31, 2022. GL Cash balance Bank statement balance Deposits in transit $1,869.60 1,951.20 271.20 Outstanding...

-

As the bookkeeper of Rose Company of Drumheller, you received the bank statement from TD Canada Trust indicating a balance of $5,820. The ending chequebook balance was $6,321. Prepare the bank...

-

Antiinfective drugs destroy cells that have invaded the body. They do not specifically destroy only the cell of the invader, and because of this, many adverse effects can be anticipated when an...

-

1. How can the use of MRP contribute to profitability? 2. What are some of the unforeseen costs of ERP implementation? Discuss.

-

The COVID-19 pandemic resulted in strains on the healthcare supply chain. Discuss why supply chain management (SCM) is important to healthcare organizations. Furthermore, explain how healthcare...

-

Financial reporting quality relates to the quality of the information regarding the financial wellbeing of a firm that is contained in financial reports, including note disclosures. The quality of...

-

Exercises: Situational questions. Each answer must be supported by a legal basis. 1. What is the difference when an employee was dismissed for just cause than he was dismissed for an authorized...

-

In international trade, what is the difference between a contracted agent in a foreign country and a contracted distributor?What are some of the key issues that can arise in the relationship between...

-

Norman Jones, an economic historian at the University of Utah, has described the views of the ancient Greek philosopher Aristotle on interest: Aristotle defined money as a good that was consumed by...

-

Draw and label the E and Z isomers for each of the following compounds: 1. CH3CH2CH==CHCH3 2. 3. 4. CH,CH2C CHCH2CH Cl CH3CH2CH2CH2 CH CH2CCCH2CI CHCH3 CH3 HOCH CH CCC CH O-CH C(CH

-

From the partial worksheet in Figure journalize the closing entries for December 31 for G. JacksonCo. G. JACKSON CO WORKSHEET FOR YEAR ENDED DECEMBER 31, 201x Balance Sheet Dr Income Statement...

-

From the worksheet in Exercise 12A-3, prepare the assets section of a classified balance sheet. In Exercise12A-3, G. JACKSON CO WORKSHEET FOR YEAR ENDED DECEMBER 31, 201x Balance Sheet Dr Income...

-

On December 31, 2012, $290 of salaries has been accrued. (Salaries before the accrued amount totaled $28,000.) The next payroll to be paid will be on February 3, 2013, for $5,700. Please do the...

-

Break-Even Sales and Sales to Realize Income from Operations For the current year ending October 31, Yentling Company expects fixed costs of $537,600, a unit variable cost of $50, and a unit selling...

-

You buy a stock for $35 per share. One year later you receive a dividend of $3.50 per share and sell the stock for $30 per share. What is your total rate of return on this investment? What is your...

-

Filippucci Company used a budgeted indirect-cost rate for its manufacturing operations, the amount allocated ($200,000) is different from the actual amount incurred ($225,000). Ending balances in the...

Study smarter with the SolutionInn App