Alex Yeoman Painting Co. of Yellowknife uses a purchases journal (page 21) and a general journal (page

Question:

Alex Yeoman Painting Co. of Yellowknife uses a purchases journal (page 21) and a general journal (page 32) to record the following transactions. The GST rate is 5%.

2018 Aug. 3 Purchased paint supplies for resale from European Import Paint Co., invoice No. 653, dated August 2, terms net 15 days, $1,362 plus GST.

7 Purchased merchandise on account from Rob Co., invoice No. 250, dated August 7, terms 2/10, n/60, $920, plus GST.

10 Purchased merchandise on account from RJ Co., invoice No. 1124, dated August 7, terms 1/10, n/60, $1,626, plus GST.

13 Purchased store supplies on account from Garret Co., invoice No. 712, dated August 13, $2,680, plus GST.

14 Issued debit memo No. 8 to Rob Co. for merchandise returned, $160, plus GST, from invoice No. 250.

17 Purchased office equipment on account from Reliant Co., invoice No. 873, dated August 14, $2,610, plus GST.

24 Purchased additional store supplies on account from Garret Co., invoice No. 816, dated August 24, terms 2/10, n/30, $725, plus GST.

28 Purchased paint for resale from European Import Paint Co., invoice No. 713, dated August 27, terms net 15 days, $2,740, plus GST.

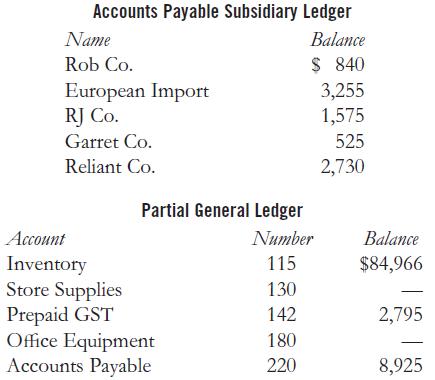

The paint store has decided to keep a separate column for the purchases of supplies in the purchases journal and also has a separate column for GST. The account balances as of August 1, 2018, are as follows:

Required

a. Journalize the transactions.

b. Post and record as appropriate.

c. Prepare a schedule of accounts payable as of August 31, 2018.

Accounts PayableAccounts payable (AP) are bills to be paid as part of the normal course of business.This is a standard accounting term, one of the most common liabilities, which normally appears in the balance sheet listing of liabilities. Businesses receive...

Step by Step Answer:

College Accounting A Practical Approach

ISBN: 978-0134166698

13th Canadian edition

Authors: Jeffrey Slater, Debra Good