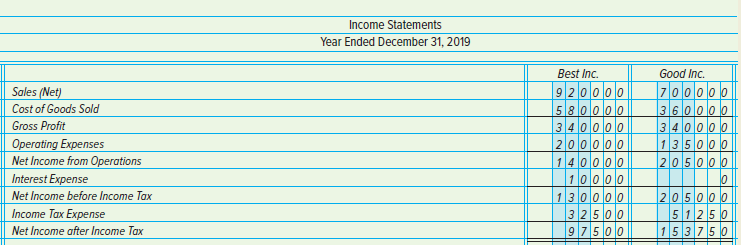

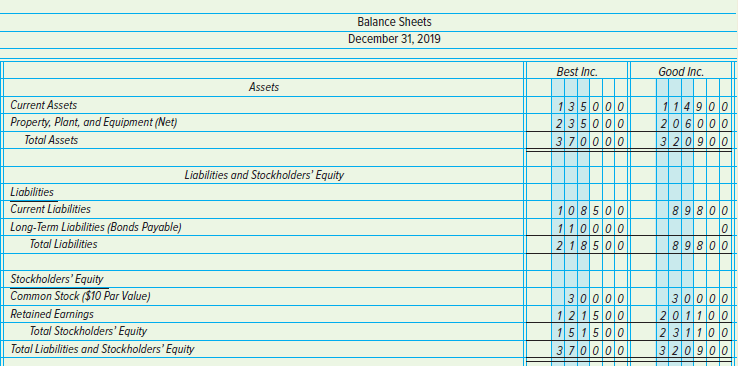

Below you will find the condensed financial statements for Best Inc. and Good Inc. for 2019. INSTRUCTIONS

Question:

INSTRUCTIONS

1. Compute the following ratios for each company:

a. Rate of return on net sales

b. Rate of return on total assets at year-end

c. Rate of return on stockholders€™ equity at year-end

d. Earnings per share of common stock

e. Ratio of stockholders€™ equity to total equities

f. Current ratio

g. Asset turnover

h. Book value per share of common stock

2. Comment on any similarities or differences in the two companies€™ ratios. When possible, comment on the cause for these differences.

3. From the investor€™s point of view, is one company more at risk than the other?

4. Would you grant a five-year loan to either company? Explain.

Analyze: Assume that Good Inc. believes that it can cut the cost of goods sold by 5 percent in 2020 while keeping net sales and operating expenses at 2019 levels. If the company met this goal, discuss the potential implications to the rate of return on sales and earnings per share. Assume a tax rate of 25 percent.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

College Accounting Chapters 1-30

ISBN: 978-1259631115

15th edition

Authors: John Price, M. David Haddock, Michael Farina