Brooks Inc.s fiscal year ends December 31. Selected transactions for the period 20-1 through 20-8 involving bonds

Question:

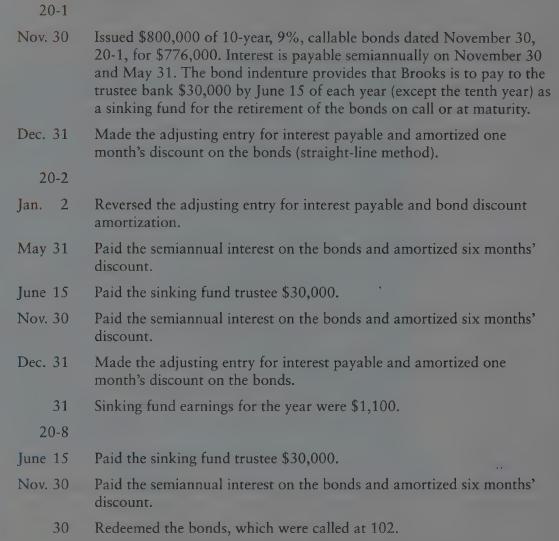

Brooks Inc.’s fiscal year ends December 31. Selected transactions for the period 20-1 through 20-8 involving bonds payable issued by Brooks are as follows:

The balance in the bond discount account is $7,200 after the payment of interest and amortization of discount have been entered. The cash balance in the sinking fund is $320,000 which is applied to the redemption. Paid the sinking fund trustee the additional cash needed to pay off the bonds. (Hint:

First make the entry for payment to the sinking fund, then make the entry for redemption of the bonds.)

REQUIRED

a. Enter the transactions in general journal form.

b. Calculate the carrying value of the bonds as of December 31, 20-2.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: