Browning Appraisal Service has the following payroll informa tion for the week ended December 7. Assumed tax

Question:

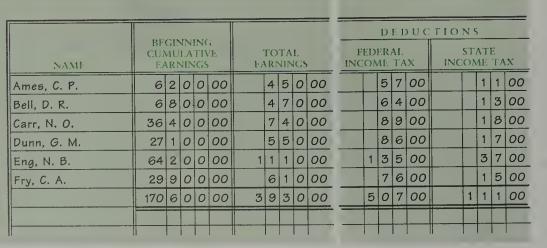

Browning Appraisal Service has the following payroll informa¬

tion for the week ended December 7.

Assumed tax rates are as follows:

a. FICA: Social Security, 6.2 percent (.062) on the first $62,700 for each employee and Medicare, 1.45 percent (.0145) on all earnings for each employee.

b. State unemployment tax, 5.4 percent (.054) on the first $7,000 for each employee.

c. Federal unemployment tax, .8 percent (.008) on the first $7,000 for each employee.

Instructions 1. Complete the payroll register, page 72.

2. Prepare a general journal entry to record the payroll as of December 7. The company’s general ledger contains a Salary Expense account and a Salaries Payable account.

3. Prepare a general journal entry to record the payroll taxes as of December 7.

4. Assuming that the firm uses a special payroll bank account, make the entries in the general journal to record the transfer of cash to the Cash-Payroll Bank Account and the payment of salaries, Ck. No. 412, on December 9. Payroll Check Figure checks begin with Ck. No. 714 in the payroll register. Payroll Tax Expense, $272.13

Step by Step Answer:

College Accounting Chapters 1-26

ISBN: 9780395796993

6th Edition

Authors: Douglas J. McQuaig, Patricia A. Bille