Question:

Damon Young has started his own business, Home and Away Inspections.

He inspects property for buyers and sellers of real estate. Young rents office space and has a part-time assistant to answer the phone and help with inspections. The transactions for the month of September are as follows:

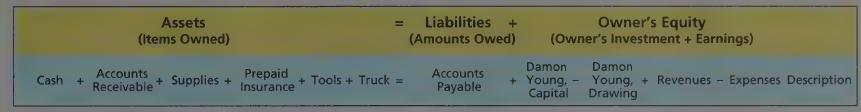

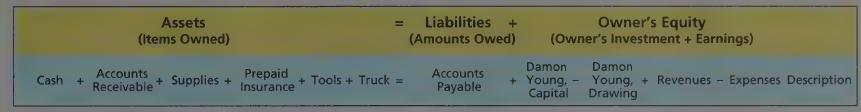

REQUIRED 1. Enter the transactions in an accounting equation similar to the one illustrated on the following page. After each transaction, show the new amount for each account.

2. Compute the ending balances for all accounts.

3. Prepare an income statement for Home and Away Inspections for the month of September 20--.

4. Prepare a statement of owner’s equity for Home and Away Inspections for the month of September 20--.

5. Prepare a balance sheet for Home and Away Inspections as of September 30, 20--.

Transcribed Image Text:

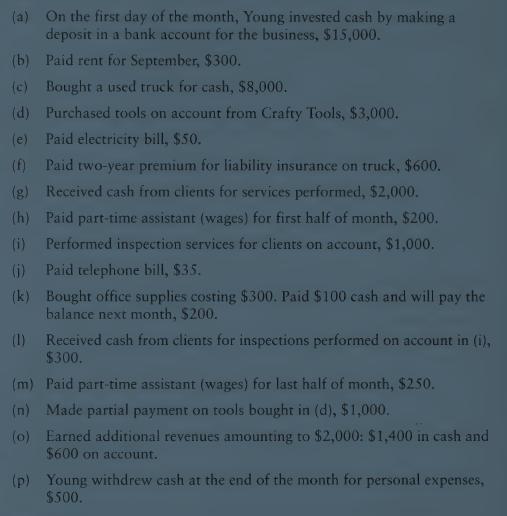

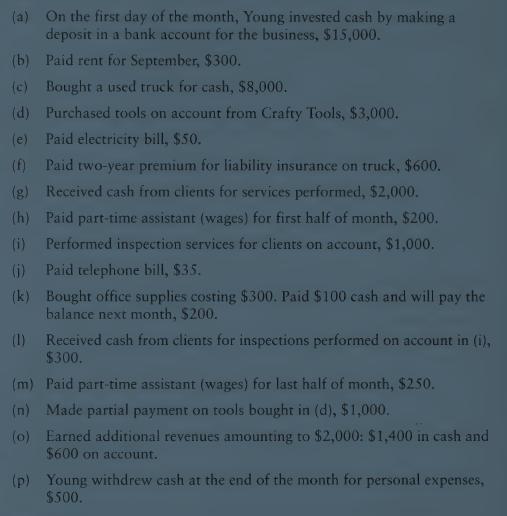

(a) On the first day of the month, Young invested cash by making a deposit in a bank account for the business, $15,000. (b) Paid rent for September, $300. (c) Bought a used truck for cash, $8,000. (d) Purchased tools on account from Crafty Tools, $3,000. (e) Paid electricity bill, $50. (f) Paid two-year premium for liability insurance on truck, $600. (g) Received cash from clients for services performed, $2,000. (h) Paid part-time assistant (wages) for first half of month, $200. (i) Performed inspection services for clients on account, $1,000. (j) Paid telephone bill, $35. (k) Bought office supplies costing $300. Paid $100 cash and will pay the balance next month, $200. (1) Received cash from clients for inspections performed on account in (i), $300. (m) Paid part-time assistant (wages) for last half of month, $250. (n) Made partial payment on tools bought in (d), $1,000. (o) Earned additional revenues amounting to $2,000: $1,400 in cash and $600 on account. (p) Young withdrew cash at the end of the month for personal expenses, $500.