Question:

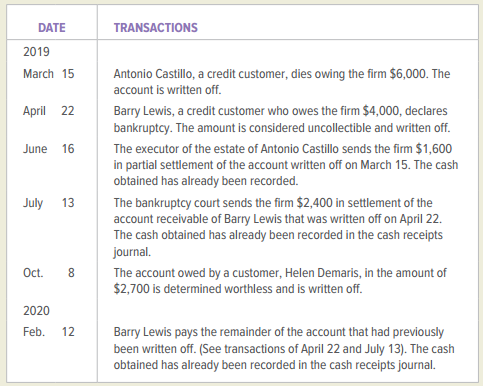

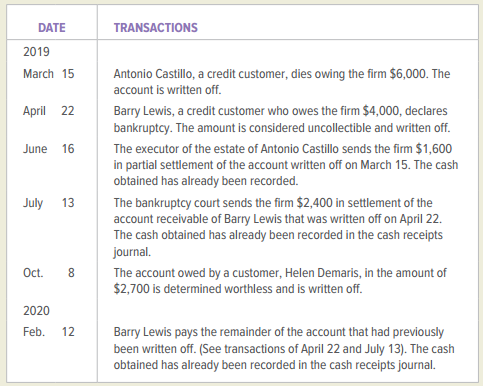

Interactive Planning Software uses the direct charge-off method to account for uncollectible accounts expenses as they occur. Selected transactions for 2019 and 2020 follow. The accounts involved are Accounts Receivable, Notes Receivable, and Uncollectible Accounts Expense. Record each transaction in general journal form.

Analyze: When the worksheet is prepared at the end of 2019, what balance should be listed for Uncollectible Accounts Expense? Assume that the transactions given are the only transactions that affected the account.

Transcribed Image Text:

TRANSACTIONS DATE 2019 Antonio Castillo, a credit customer, dies owing the firm $6,000. The March 15 account is written off. April 22 Barry Lewis, a credit customer who owes the firm $4,000, declares bankruptcy. The amount is considered uncllectible and written off. The executor of the estate of Antonio Castillo sends the firm $1,600 in partial settlement of the account written off on March 15. The cash obtained has already been recorded. June 16 The bankruptcy court sends the firm $2,400 in settlement of the account receivable of Barry Lewis that was written off on April 22. The cash obtained has already been recorded in the cash receipts journal. July 13 Oct. The account owed by a customer, Helen Demaris, in the amount of $2,700 is determined worthless and is written off. 2020 Feb. 12 Barry Lewis pays the remainder of the account that had previously been written off. (See transactions of April 22 and July 13). The cash obtained has already been recorded in the cash receipts journal.