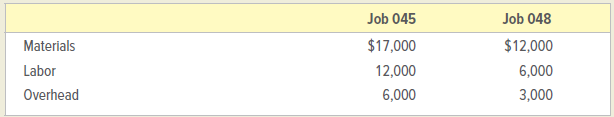

Oak Cabinet Company builds kitchen cabinets. On November 1, 2019, two jobs, Job 045 and Job 048,

Question:

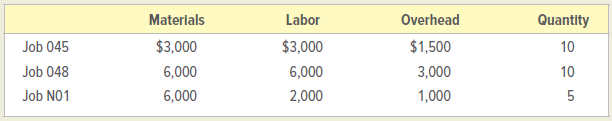

During November, Job N01 was begun. Following are the November costs incurred for each of the three jobs:

Manufacturing overhead is applied at the rate of 50 percent of direct labor costs. During November, actual manufacturing overhead costs of $5,400 were incurred. Job 045 was completed on November 20 and was delivered to the customer. The sales price was $75,000.

INSTRUCTIONS

1. Prepare job order cost sheets for the three jobs. Enter the beginning balances applicable to Jobs 045 and 048.

2. Post the costs of the materials and labor for November to the job order cost sheets.

3. Post the overhead amounts that should be applied to the three jobs worked on during the month on the job cost sheets.

4. Give the entry in general journal form to transfer the cost of the job completed from work in process to finished goods.

5. Compute the amount of underapplied or overapplied overhead for November. Give the journal entry to transfer your result to Cost of Goods Sold.

Analyze: What adjusted cost of goods sold should be reported for November manufacturing activities?

Step by Step Answer:

College Accounting Chapters 1-30

ISBN: 978-1259631115

15th edition

Authors: John Price, M. David Haddock, Michael Farina