Prepare a bank reconciliation and record adjustments Shamara Systems Co. most recently reconciled its bank balance on

Question:

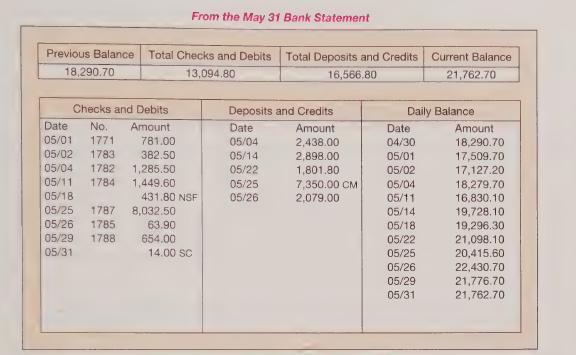

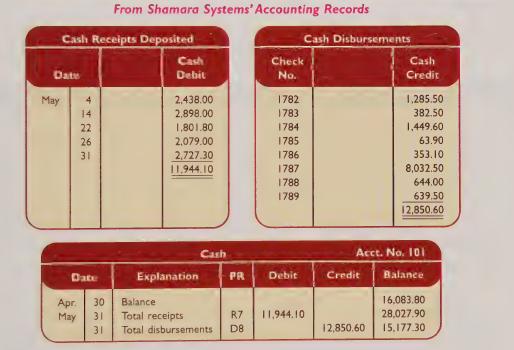

Prepare a bank reconciliation and record adjustments Shamara Systems Co. most recently reconciled its bank balance on April 30 and reported two checks outstanding at that time, No. 1771 for \($781.00\) and No. 1780 for \($1,425.90\). The following information is available for its May 31, 2008, reconciliation.

Additional Information:

Check No. 1788 is correctly drawn for \($654\) to pay for May utilities; however, the recordkeeper misread the amount and entered it in the accounting records with a debit to Utilities Expense and a credit to Cash for \($644\). The bank paid and deducted the correct amount. The NSF check shown in the statement was originally received from a customer, W. Sox, in payment of her account. The company has not yet recorded its return. The credit memorandum is from a \($7,400\) note that the bank collected for the company. The bank deducted a \($50\) collection fee and deposited the remainder in the company’s account. The collection and fee have not yet been recorded.

Required:

1. Prepare the May 31, 2008, bank reconciliation for Shamara Systems.

2. Prepare the journal entries to adjust the book balance of cash to the reconciled balance.

Analysis Component:

3. The bank statement reveals that some of the prenumbered checks in the sequence are missing. Describe three possible situations to explain this.

Step by Step Answer:

College Accounting Ch 1-14

ISBN: 9781260904314

1st Edition

Authors: John Wild, Vernon Richardson, Ken Shaw