Question:

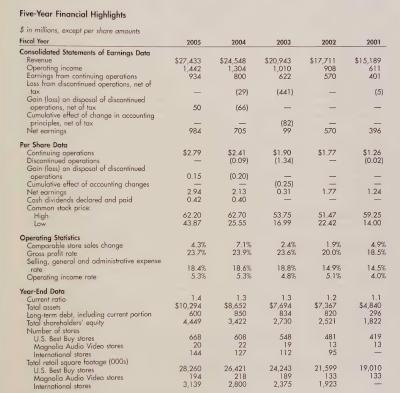

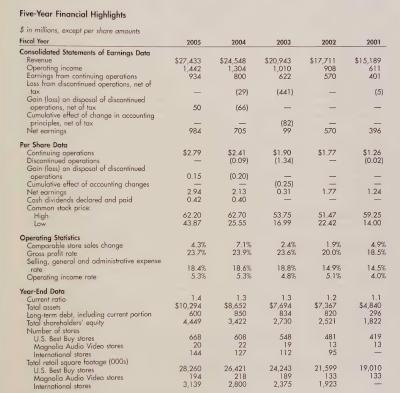

Refer to Best Buy’s financial statements in Appendix A to answer the following.

1. For both fiscal year-ends February 26, 2005, and February 28, 2004, identify the total amount of cash and cash equivalents. Determine the percent this amount represents of total current assets, total current liabilities, total shareholders’ equity, and total assets for both years. Comment on any trends.

2. For fiscal years ended February 26, 2005, and February 28, 2004, use the information in the statement of cash flows to determine the percent change between the beginning and ending year amounts of cash and cash equivalents.

3. Compute the days’ sales uncollected as of February 26, 2005, and February 28, 2004. Has the collection of receivables improved? Are accounts receivable an important asset for Best Buy? Explain.

Fast Forward

4. Access Best Buy’s financial statements for fiscal years ending after February 26, 2005, from its Website (BestBuy.com) or the SEC’s EDGAR database (www.sEc.gov). Recompute its days’ sales uncollected for fiscal years ending after February 26, 2005. Compare this to the days’ sales uncollected for 2005 and 2004.

Appendix A:

Transcribed Image Text:

Five-Year Financial Highlights $ in millions, except per share amounts Fiscal Year Consolidated Statements of Earnings Date Revenue Operating income Earnings from continuing operations Loss from discontinued operations, net of fax Gain flos) on disposal of discontinued operations, not of tax Cumulative effect of change in accounting principles, cet of tax Naming Per Share Data 2005 2004 2003 2002 2001 $27.433 $24.548 1442 1,304 $20,943 1,010 $17,711 $15,189 908 611 934 800 622 570 401 Continuing operations $2.79 Discontinued operations 1918 1 (29) (441) (5) 50 (66) (82) 705 99 570 1B 396 $2.41 $1.90 $1.77 $1.26 (0.09) (1.34) (0.02) Gain floss) an disposal of discontinued operations 0.15 (0.20) Cumulative effect of accounting changes (0.25) Net earnings 294 213 031 17 1.24 Cash dividends declared and paid 0.42 0.40 Common stock price High 62.20 62.70 53.75 51.47 59.25 Low 43.87 25.55 16.99 22:42 14:00 Operating Statistics Comparable vore sales change 4.3% 71% 2.4% 1.9% 4.9% Gross profit rote 23.7% 23.9% 23.6% 20.0% 18.5% Selling, general and administrative expense 18.4% 18:6% 18.8% 14.9% 14.5% Operating income rate 5.3% 5.3% 4.8% 5.1% 4.0% Year-End Data Current ratio 1.4 13 13 1.2 1.1 Total assets $10,294 $8,652 $7694 $7,367 $4,840 Long term debt, including current portion 600 850 834 820 296 Total shareholders' equity 4449 3,422 2,730 2,521 1,822 Number of stor U.S. Best Buy stores Magnolia Audio Video stores International stores U.S. Best Buy stores Magnolio Audio Video stores 668 608 548 481 419 20 22 19 13 144 127 112 95 Total retail square footage (000) 28,260 International stores 194 3,139 26.421 218 2,800 24,243 189 2,375 21,599 133 19,010 133 1,923