Refer to the information for Problem 10-1A on pages 458459. Required 1. Record the transactions for January

Question:

Refer to the information for Problem 10-1A on pages 458–459.

Required

1. Record the transactions for January using a sales journal, page 73; a purchases journal, page 56; a cash receipts journal, page 38; a cash payments journal, page 45; and a general journal, page 100. Assume the periodic inventory method is used.

2. Post daily all entries involving customer accounts to the accounts receivable ledger.

3. Post daily all entries involving creditor accounts to the accounts payable ledger.

4. Post daily those entries involving the Other Accounts columns and the general journal to the general ledger. Write the owner’s name in the Capital and Drawing accounts.

5. Add the columns of the special journals and prove the equality of the debit and credit totals.

6. Post the appropriate totals of the special journals to the general ledger.

7. Prepare a trial balance.

8. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?

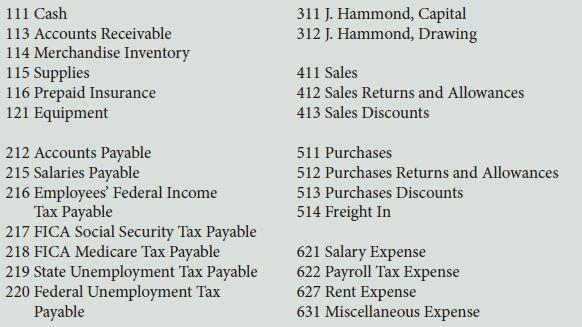

Data From Problem 10-1A:

The following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Hammond Auto Supply does not track cash sales by customer.

Jan. 2 Issued Ck. No. 6981 to JSS Management Company for monthly rent, $775.

2 J. Hammond, the owner, invested an additional $3,500 in the business.

4 Bought merchandise on account from Valencia and Company, invoice no. A691, $2,930; terms 2/10, n/30; dated January 2.

4 Received check from Vega Appliance for $980 in payment of $1,000 invoice less discount.

4 Sold merchandise on account to L. Paul, invoice no. 6483, $850.

6 Received check from Petty, Inc., $637, in payment of $650 invoice less discount.

7 Issued Ck. No. 6982, $588, to Fischer and Son, in payment of invoice no. C1272 for $600 less discount.

7 Bought supplies on account from Doyle Office Supply, invoice no. 1906B, $108; terms net 30 days.

7 Sold merchandise on account to Ellison and Clay, invoice no. 6484, $787.

9 Issued credit memo no. 43 to L. Paul, $54, for merchandise returned.

11 Cash sales for January 1 through January 10, $4,863.20.

11 Issued Ck. No. 6983, $2,871.40, to Valencia and Company, in payment of $2,930 invoice less discount.

14 Sold merchandise on account to Vega Appliance, invoice no. 6485, $2,050.

Jan. 18 Bought merchandise on account from Costa Products, invoice no. 7281D, $4,854; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to the invoice, $147 (total $5,001).

21 Issued Ck. No. 6984, $194, to M. Miller for miscellaneous expenses not recorded previously.

21 Cash sales for January 11 through January 20, $4,591.

23 Issued Ck. No. 6985 to Forbes Freight, $96, for freight charges on merchandise purchased on January 4.

23 Received credit memo no. 163, $376, from Costa Products for merchandise returned.

29 Sold merchandise on account to Bruce Supply, invoice no. 6486, $1,835.

31 Cash sales for January 21 through January 31, $4,428.

31 Issued Ck. No. 6986, $53, to M. Miller for miscellaneous expenses not recorded previously.

31 Recorded payroll entry from the payroll register: total salaries, $6,200; employees’ federal income tax withheld, $872; FICA Social Security tax withheld, $384.40, FICA Medicare tax withheld, $89.90.

31 Recorded the payroll taxes: Social Security tax, $384.40, FICA Medicare tax, $89.90; state unemployment tax, $334.80; federal unemployment tax, $37.20.

31 Issued Ck. No. 6987, $4,853.70, for salaries for the month.

31 J. Hammond, the owner, withdrew $1,000 for personal use, Ck. No. 6988.

Step by Step Answer: