Sales journal and accounts receivable subsidiary ledger Acorn Industries completes the following transactions during July, its first

Question:

Sales journal and accounts receivable subsidiary ledger Acorn Industries completes the following transactions during July, its first month of operations (the terms of all its credit sales are 2/10, n/30). A tax rate of 10% applies to all sales.

July

5 Sold merchandise on credit to Kim Nettle, Invoice No. 918, for \($19,200.\)

6 Sold merchandise on credit to Ruth Blake, Invoice No. 919, for \($7,500.\)

13 Sold merchandise on credit to Ashton Moore, Invoice No. 920, for \($8,550.\)

14 Sold merchandise on credit to Kim Nettle, Invoice No. 921, for \($5,100.\)

29 Sold merchandise on credit to Ruth Blake, Invoice No. 922, for \($17,500.\)

30 Sold merchandise on credit to Ashton Moore, Invoice No. 923, for \($16,820.\)

Required

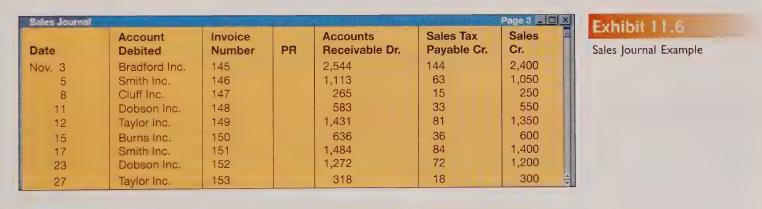

I. Prepare a sales journal like that in Exhibit 11.6. Number the sales journal as page 3.

2. Open the following general ledger accounts: Accounts Receivable, Sales Tax Payable, and Sales. Also open accounts receivable subsidiary ledger accounts for Kim Nettle, Ashton Moore, and Ruth Blake.

Post the transactions to the subsidiary ledger accounts. Prepare the month-end postings to the general ledger accounts.

Step by Step Answer:

College Accounting Ch 1-14

ISBN: 9781260904314

1st Edition

Authors: John Wild, Vernon Richardson, Ken Shaw