Sales journal, subsidiary ledger, and schedule of accounts receivable Church Company completes the following transactions during March,

Question:

Sales journal, subsidiary ledger, and schedule of accounts receivable

Church Company completes the following transactions during March, its first month of operations (terms for all its credit sales are 2/10, n/30).

Mar.

2. Sold merchandise on credit to Min Cho, Invoice No. 854, for \($16,800\) plus sales tax of \($1,176.\)

3 Sold merchandise on credit to Linda Witt, Invoice No. 855, for \($10,200\) plus sales tax of \($714.\)

10 Sold merchandise on credit to Jovita Albany, Invoice No. 856, for \($5,600\) plus sales tax of \($392.\)

27. Sold merchandise on credit to Jovita Albany, Invoice No. 857, for \($14,910\) plus sales tax of \($1,044.\)

28 Sold merchandise on credit to Linda Witt, Invoice No. 858, for \($4,315\) plus sales tax of \($302.\)

Required

1. Open the following general ledger accounts: Accounts Receivable, Sales, and Sales Tax Payable. Open the following accounts receivable subsidiary ledger accounts: Jovita Albany, Min Cho, and Linda Witt.

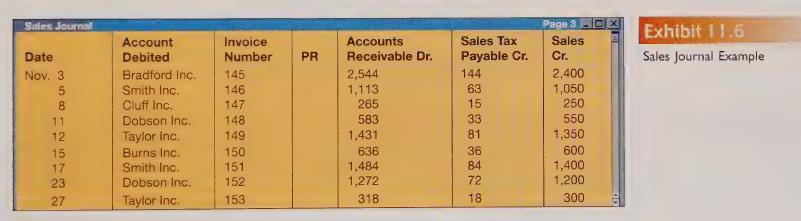

2. Enter the transactions in a sales journal like Exhibit 11.6. Number all journal pages as page 2.

3. Post all transactions to the accounts receivable subsidiary ledger and its month-end totals to the general ledger.

4. Prove the accuracy of the subsidiary ledger by preparing a schedule of accounts receivable as of March 31.

Step by Step Answer:

College Accounting Ch 1-14

ISBN: 9781260904314

1st Edition

Authors: John Wild, Vernon Richardson, Ken Shaw