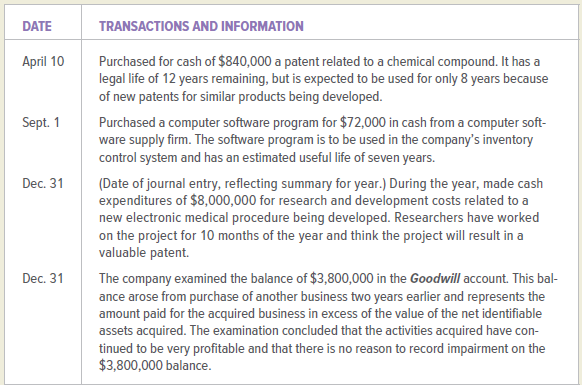

Selected accounts of the Mayo Medical Labs are listed below. Also given are some transactions and events

Question:

INSTRUCTIONS

1. Record in general journal form the transactions for 2019 described.

2. Record amortization of the intangible assets for the year ended December 31, 2019.

3. Indicate what steps should be taken, if any, to properly account for the balance of $1,200,000 in the Goodwill account on December 31. The following accounts related to intangible assets are found in Mayo€™s general ledger:

ACCOUNTS

Cash...................................Research and Development Expense

Patents...............................Amortization of Patents

Computer Software............Amortization of Computer Software

Goodwill.............................Impairment of Intangibles

Analyze: Suppose that the examination of goodwill had revealed that the benefits (future profits) resulting from the acquisition two years ago are decreasing. Based on the estimated value of the excess of the future profits over the value of the net assets acquired, the value of goodwill is estimated to be currently only $2,600,000. What accounting entry, if any, should be made to record this fact?

Intangible AssetsAn intangible asset is a resource controlled by an entity without physical substance. Unlike other assets, an intangible asset has no physical existence and you cannot touch it.Types of Intangible Assets and ExamplesSome examples are patented...

Step by Step Answer:

College Accounting Chapters 1-30

ISBN: 978-1259631115

15th edition

Authors: John Price, M. David Haddock, Michael Farina