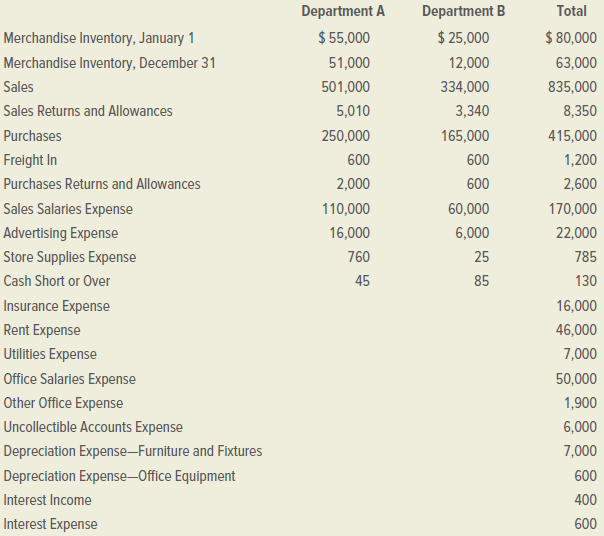

Selected information from the adjusted trial balance of Warmers Inc. as of December 31, 2019, follows: INSTRUCTIONS

Question:

INSTRUCTIONS

Prepare a departmental income statement for the year ended December 31, 2019. The bases for allocating indirect expenses are given below. Show all allocations in a neat and orderly form.

1. Insurance Expense: in proportion to the total of the furniture and fixtures (the gross assets before depreciation) and the ending inventory in the departments. These totals are as follows:

Department A................................$180,000

Department B..................................120,000

Total...............................................$300,000

2. Rent Expense and Utilities Expense: on the basis of floor space occupied, as follows:

Department A..................................4,900 square feet

Department B..................................2,100 square feet

Total.................................................7,000 square feet

3. Office Salaries Expense, Other Office Expenses, and Depreciation Expense€”Office Equipment: on the basis of the gross sales in each department.

4. Uncollectible Accounts Expense: on the basis of net sales in each department.

5. Depreciation Expense€”Furniture and Fixtures: in proportion to cost of furniture and fixtures in each department. These costs are as follows.

Department A..................................$39,000

Department B....................................21,000

Total.................................................$60,000

Analyze: Which department reports the higher return on net sales?

Ending InventoryThe ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =...

Step by Step Answer:

College Accounting Chapters 1-30

ISBN: 978-1259631115

15th edition

Authors: John Price, M. David Haddock, Michael Farina