The following information on earnings and deductions for the pay P.0.1 period ended December 14 is from

Question:

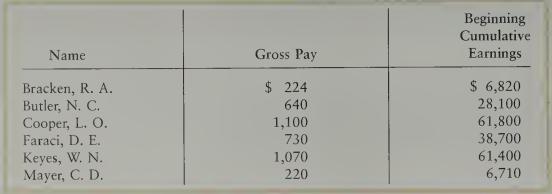

The following information on earnings and deductions for the pay P.0.1 period ended December 14 is from McMaster Company’s payroll records:

For each employee, the Social Security tax is 6.2 percent of the first $62,700, and the Medicare tax is 1.45 percent on all earnings. The federal unemployment tax is .8 percent of the first $7,000 of earnings of each employee. The state unem¬

ployment tax is 5.4 percent of the same base. Determine the total taxable earn¬

ings for unemployment. Social Security, and Medicare. Prepare a general journal entry to record the employer’s payroll taxes.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

College Accounting Chapters 1-26

ISBN: 9780395796993

6th Edition

Authors: Douglas J. McQuaig, Patricia A. Bille

Question Posted: