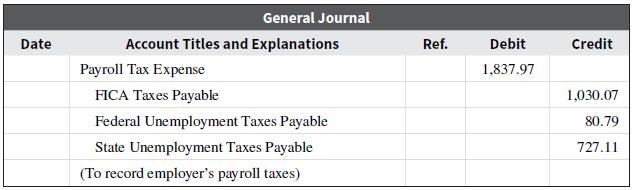

The following journal entry for payroll taxes has been recorded by Shania for her hair salon business.

Question:

The following journal entry for payroll taxes has been recorded by Shania for her hair salon business. Assume federal income tax is $3,190 and state income tax is $278. Prepare the journal entry to record payment of the payroll taxes, assuming all taxes were paid on the same day.

Transcribed Image Text:

General Journal Date Account Titles and Explanations Ref. Debit Credit Payroll Tax Expense 1,837.97 FICA Taxes Payable 1,030.07 Federal Unemployment Taxes Payable 80.79 State Unemployment Taxes Payable 727.11 (To record employer's payroll taxes)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 47% (21 reviews)

FICA Taxes Payable 103007 103007 206014 Federal Unemploy...View the full answer

Answered By

Saleem Abbas

Have worked in academic writing for an a years as my part-time job.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

College Accounting

ISBN: 1986

1st Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Deanna C. Martin, Jill E. Mitchell

Question Posted:

Students also viewed these Business questions

-

Romero Brothers Contracting reports a $ 1,200,000 bi- weekly payroll. Romero and its employees must pay Social Security ( FICA) taxes and none of the employees has exceeded the wage base. Income...

-

(Accounting PrinciplesComprehensive) Presented below are a number of business transactions that occurred during the current year for Fresh Horses, Inc. In each of the situations, discuss the...

-

The following journal entry summarizes for the current year the income tax expense of Wilsons Software Warehouse: Income Tax Expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ....

-

Question 7: The owner of a small social services management consulting firm wants to minimize the total number of hours it will take to complete four projects for a new client. Accordingly, she has...

-

A 236U nucleus undergoes fission and breaks into two middle- mass fragments, 140Xe and 96Sr. (a) By what percentage does the surface area of the fission products differ from that of the original 236U...

-

DE 16-13 Answer these questions about consolidation accounting: 1. Define a parent company. Define a subsidiary company. 2. Which company's name appears on the consolidated financial statements? How...

-

Categorical syllogisms have two premises and a conclusion that describe the relation between two categories by using statements that begin with all, no, or some. L01

-

The paralegal is assigned the task of preparing an office legal memorandum. The memorandum is due in 10 days, and there is a 5-page limit. The facts and law are as follows: Facts: Mary was Tom's...

-

I Garza and Neely CPAs, are preparing their service revenue (sales) budget for the coming year (2021). The practice is divided into the three departments: auditing, tax, and consulting. Billable...

-

941, SUTA and 940 Tax Return Preparation Ingram Heating & Cooling reports the following earnings and deductions for their employees for ...

-

Jose started a consulting firm last year and needs to hire one employee due to growth in the business. He is confused about all the tax forms he must complete once he starts paying payroll. For each...

-

Wages paid for the second quarter for Wang Law Firm were $56,792.00. All wages were subject to FICA taxes (the 7.65% FICA tax rate consists of the Social Security tax rate of 6.2% on salaries and...

-

There are 35 cells with no molecules, 25 with one molecule, 25 with two molecules, and 15 with three molecules. Suppose that the number N of molecules of toxin left in a cell after 10.0 min is...

-

Air enters a 5.5-cm-diameter adiabatic duct with inlet conditions of \(\mathrm{Ma}_{1}=2.2, T_{1}=250 \mathrm{~K}\), and \(P_{1}=60 \mathrm{kPa}\), and exits at a Mach number of...

-

At the various activity levels shown, Taylor Company incurred the following costs. Required: Identify each of these costs as fixed, variable, or mixed. Units sold 20 40 60 80 100 a. Total salary cost...

-

Indicate whether each of the following types of transactions will either (a) increase stockholders' equity or (b) decrease stockholders' equity: 1. expenses 2. revenues 3. stockholders' investments...

-

The following selected transactions were completed by Lindbergh Delivery Service during October: 1. Received cash from issuing capital stock, \($75,000\). 2. Paid rent for October, \($4,200\). 3....

-

Murray Kiser operates his own catering service. Summary financial data for February are presented in equation form as follows. Each line designated by a number indicates the effect of a transaction...

-

In the original Western set-covering model in Figure 6.22, we used the number of hubs as the objective to minimize. Suppose instead that there is a fixed cost of locating a hub in any city, where...

-

The following selected accounts and normal balances existed at year-end. Notice that expenses exceed revenue in this period. Make the four journal entries required to close the books: Accounts...

-

A friend owns and operates her own business and is concerned about completing her tax return. She owns several assets and uses straight-line depreciation for business purposes. She intended to use...

-

Creative Solutions purchased a patent from Russell Lazarus, an inventor. At the time of the purchase, the patent had two years remaining. The president of Creative Solutions decided to have the...

-

On April 1, 20-3, Kwik Kopy Printing purchased a copy machine for $50,000. The estimated life of the machine is five years, and it has an estimated salvage value of $5,000. The machine was used until...

-

Kindly Provide brief answers to the following: a) Why do we add floatation costs in the calculations of individual components costs? b) List and briefly explain the qualitative and quantitative...

-

Which of the following statements is correct. On average, the most efficient strategy to create value for existing shareholders is: To buy back shares To offer new products in a growing market To...

-

Which investment should I choose? Bond X: AA Corporate bond, Par=$1,000, Coupon rate=5% (semiannual coupons), 5 years to maturity Bond Y: AA Corporate bond, Par=$5,000, Coupon rate=5.5% (semiannual...

Study smarter with the SolutionInn App