The following transactions occurred at Wilson Company during 2019: INSTRUCTIONS In each case, assume that straight-line depreciation

Question:

INSTRUCTIONS

In each case, assume that straight-line depreciation is used and that depreciation was last recorded on December 31, 2018. Compute depreciation to the nearest whole dollar.

1. Record in general journal form the two trade-in transactions on April 2 and July 8.

2. Record the sale of the refrigeration unit, assuming:

a. the sales price was $27,000.

b. the sales price was $20,400.

Analyze: What accounting concepts underlie the accounting treatments for the transactions of April 2 and July 8?

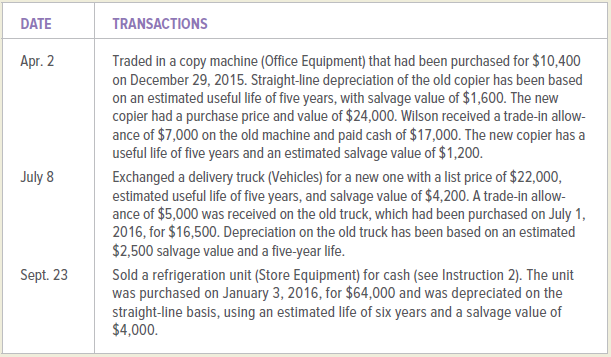

DATE TRANSACTIONS Apr. 2 Traded in a copy machine (Office Equipment) that had been purchased for $10,400 on December 29, 2015. Straight-line depreciation of the old copier has been based on an estimated useful life of five years, with salvage value of $1,600. The new copier had a purchase price and value of $24,000. Wilson received a trade-in allow- ance of $7,000 on the old machine and paid cash of $17,000. The new copier has a useful life of five years and an estimated salvage value of $1,200. July 8 Exchanged a delivery truck (Vehicles) for a new one with a list price of $22,000, estimated useful life of five years, and salvage value of $4,200. A trade-in allow- ance of $5,000 was received on the old truck, which had been purchased on July 1, 2016, for $16,500. Depreciation on the old truck has been based on an estimated $2,500 salvage value and a five-year life. Sept. 23 Sold a refrigeration unit (Store Equipment) for cash (see Instruction 2). The unit was purchased on January 3, 2016, for $64,000 and was depreciated on the straight-line basis, using an estimated life of six years and a salvage value of $4,000.

Step by Step Answer:

GENERAL JOURNAL PAGE 1 DATE DESCRIPTION POST REF DEBIT CREDIT 2019 Apr 2 Depreciation Expense x Offi...View the full answer

College Accounting Chapters 1-30

ISBN: 978-1259631115

15th edition

Authors: John Price, M. David Haddock, Michael Farina

Related Video

In accounting terms, depreciation is defined as the reduction of the recorded cost of a fixed asset in a systematic manner until the value of the asset becomes zero or negligible. An example of fixed assets are buildings, furniture, office equipment, machinery, etc. The land is the only exception that cannot be depreciated as the value of land appreciates with time. Depreciation allows a portion of the cost of a fixed asset to be the revenue generated by the fixed asset. This is mandatory under the matching principle as revenues are recorded with their associated expenses in the accounting period when the asset is in use. This helps in getting a complete picture of the revenue

Students also viewed these Business questions

-

The following transactions occurred at the Indiana Company in 2016. Use this information to compute the company's net cash flow from financing activities for the year. 1. Holders of $200,000...

-

George Wilson dies on March 1, 2011, leaving a valid will. The will reads as follows: I leave my home, furnishings, remaining bank account balances and personal possessions to my wife Helen. I leave...

-

The following transactions occurred during March 2011 for the Wainwright Corporation. The company owns and operates a wholesale warehouse. 1. Issued 30,000 shares of common stock in exchange for...

-

An interest payment of $650 in a 20 percent tax bracket would result in a tax savings of _____.

-

What is the fixed asset turnover ratio?

-

A company is considering an investment of 1.4 million in a project that has a seven-year life. The company has estimated its discount rate at 12%. Details of the sales and costs arising from this...

-

Telling the government. The 2000 census long form asked 53 detailed questions, for example: Do you have COMPLETE plumbing facilities in this house, apartment, or mobile home; that is, 1) hot and and...

-

What items should be included in the audit status report?

-

El 31 de marzo de 2022, Vine Company emiti un pagar por $487,000, 2%, a 3 aos cuando la tasa de mercado era del 8%. Los intereses vencen cada 31 de marzo, comenzando el 31 de marzo de 2023. El ao...

-

Belton Printing Company of Baltimore has applied for a loan. Its bank has requested a budgeted income statement for the month of April 2018 and a balance sheet at April 30, 2018. The March 31, 2018,...

-

On January 6, 2019, Harris Company purchased a computer (cost, $10,000; expected life, four years; estimated salvage value , $2,000) and an eight-passenger van (cost, $76,000; estimated life, eight...

-

Freedom Company purchased four identical machines on January 4, 2019, paying $9,000 for each machine. The useful life of each machine is expected to be five years, with no salvage value expected. The...

-

The Sports Physical Therapy clinic is considering centralizing their database operations. What are their options for this centralized computing?

-

Explain the importance(s) of the Teamwork soft skill in health care. Describe in detail an example of how it may be used in a healthcare setting.

-

Write a solution to this problem in the main method of a class named " Money " Ask the user to enter a number representing an amount of money from 1 dollar to 9999 dollars (integer). Assume the user...

-

Use linspace to define -4

-

Although beer may be the beverage of choice for most 20 somethings, for 28-year-old Geoff Dillon, his drink of choice would likely be whisky. Dillon grew up watching his dad, an environmental chemist...

-

In our text, the author discusses five drivers of a green supply chain. While each is important, different companies may be more influenced by some more than others. In your discussion, give an...

-

Find the derivative of y with respect to the appropriate variable. y = csch 20

-

In a system with light damping (c < cc), the period of vibration is commonly defined as the time interval d = 2/d corresponding to two successive points where the displacement-time curve touches one...

-

Bella Floral Designs is a wholesale shop that sells flowers, plants, and plant supplies. The transactions shown below took place during January. DATE TRANSACTIONS Jan. 3 Sold a floral arrangement to...

-

J&J Appliances is a retail store that sells household appliances. Merchandise sales are subject to an 8 percent sales tax. The firm's credit sales for June are listed below Instruction 4, along with...

-

The Furniture Lot is a retail store that specializes in modern living room and dining room furniture. Merchandise sales are subject to an 8 percent sales tax. The firm's credit sales and sales...

-

Sociology

-

I am unsure how to answer question e as there are two variable changes. In each of the following, you are given two options with selected parameters. In each case, assume the risk-free rate is 6% and...

-

On January 1, Interworks paid a contractor to construct a new cell tower at a cost of $850,000. The tower had an estimated useful life of ten years and a salvage value of $100,000. Interworks...

Study smarter with the SolutionInn App