Question:

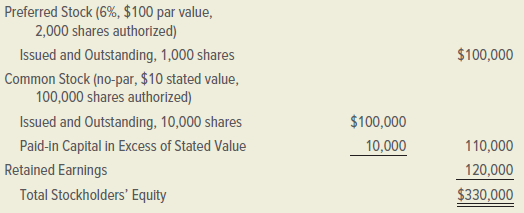

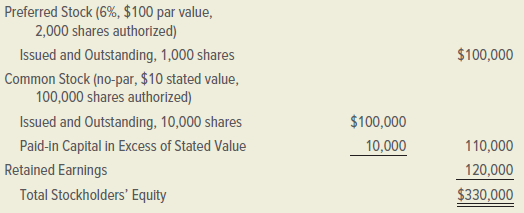

The stockholder's equity accounts of Sky Inc. on January 1, 2019, contained the following balances:

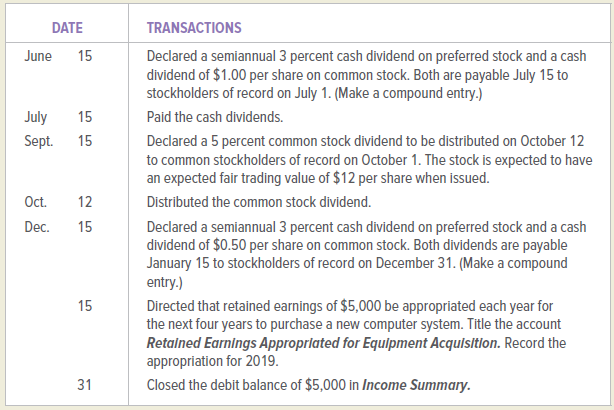

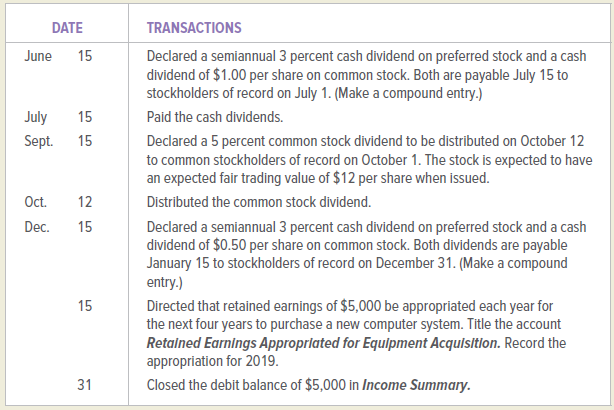

The transactions affecting stockholders’ equity during 2019 are given below. The worksheet at the end of 2019 showed a net loss of $5,000.

INSTRUCTIONS

1. Set up a ledger account (381) for Retained Earnings and record the January 1, 2019, balance.

2. Record the following transactions in general journal form using page 6. Use the account titles used in the text. No descriptions are required. Post these entries to the Retained Earnings account only.

3. Prepare a statement of retained earnings for the year 2019.

Analyze: What balances should be reflected in the Dividends Payable—Preferred account on December 31, 2019?

Transcribed Image Text:

Preferred Stock (6%, $100 par value, 2,000 shares authorized) $100,000 Issued and Outstanding, 1,000 shares Common Stock (no-par, $10 stated value, 100,000 shares authorized) $100,000 Issued and Outstanding, 10,000 shares Paid-in Capital in Excess of Stated Value 10,000 110,000 Retained Earnings 120,000 Total Stockholders' Equity $330,000 DATE TRANSACTIONS June 15 Declared a semiannual 3 percent cash dividend on preferred stock and a cash dividend of $1.00 per share on common stock. Both are payable July 15 to stockholders of record on July 1. (Make a compound entry.) July 15 Paid the cash dividends. Sept. 15 Declared a 5 percent common stock dividend to be distributed on October 12 to common stockholders of record on October 1. The stock is expected to have an expected fair trading value of $12 per share when issued. Oct. 12 Distributed the common stock dividend. Dec. 15 Declared a semiannual 3 percent cash dividend on preferred stock and a cash dividend of $0.50 per share on common stock. Both dividends are payable January 15 to stockholders of record on December 31. (Make a compound entry.) Directed that retained earnings of $5,000 be appropriated each year for the next four years to purchase a new computer system. Title the account Retalned Earnings Appropriated for Equipment Acquisition. Record the appropriation for 2019. Closed the debit balance of $5,000 in Income Summary. 15 31