Using the data in situation a of Exercise 10-1, prepare the employers September 30 journal entries to

Question:

Using the data in situation a of Exercise 10-1, prepare the employer’s September 30 journal entries to record (1) the employer s payroll tax expense and its related liabilities and (2) its tax deposits. In preparing the tax deposit entry assume that the employer has already recorded liabilities for employee payroll taxes and withholdings. The employee’s federal income taxes withheld by the employer are \($150\) for this pay period.

Exercise 10-1:

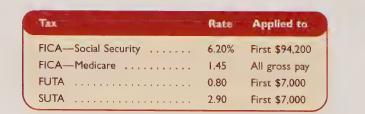

Computing payroll taxes BMX Co. has one employee, and the company is subject to the following taxes:

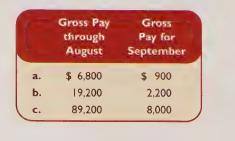

Compute BMX’s amounts for each of these four taxes as applied to the employee’s gross earnings for September under each of three separate situations (a), (b), and (c).

Step by Step Answer:

College Accounting Ch 1-14

ISBN: 9781260904314

1st Edition

Authors: John Wild, Vernon Richardson, Ken Shaw