Fitzwater Limited (an Irish company) has a foreign subsidiary in Norway, whose manager is evaluated on the

Question:

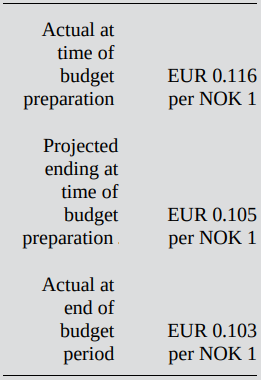

Fitzwater Limited (an Irish company) has a foreign subsidiary in Norway, whose manager is evaluated on the basis of profit in euros (EUR). In the current year, the foreign subsidiary was budgeted to generate a profit of 500,000 Norwegian kroner (NOK), and actual profit for the year was NOK 480,000. Fitzwater?s corporate management has calculated an unfavorable total budget variance for the foreign subsidiary of EUR 8,560. Current year actual and projected exchange rates are as follows:?

Required:?

a. Identify the combination of exchange rates (see Exhibit 10.10) used by Fitzwater?s corporate management in translating budgeted and actual amounts that results in the total budget variance of EUR 8,560.?

b. Determine the portion of the total budget variance calculated by Fitzwater?s corporate management that is caused by a change in the exchange rate between the EUR and the NOK. (There are three possible correct responses to this requirement.)

Exchange RateThe value of one currency for the purpose of conversion to another. Exchange Rate means on any day, for purposes of determining the Dollar Equivalent of any currency other than Dollars, the rate at which such currency may be exchanged into Dollars...

Step by Step Answer:

International Accounting

ISBN: 978-1260466539

5th edition

Authors: Timothy Doupnik, Mark Finn, Giorgio Gotti, Hector Perera