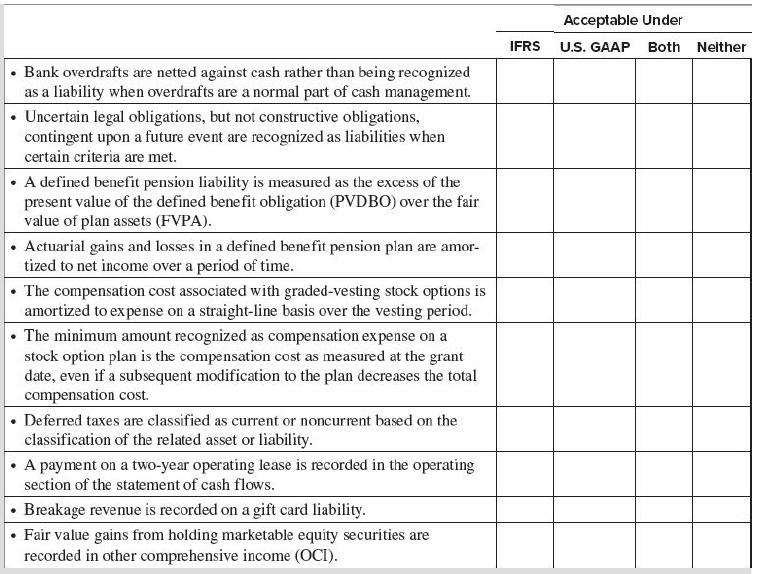

Indicate whether each of the following describes an accounting treatment that is acceptable under IFRS, U.S. GAAP,

Question:

Indicate whether each of the following describes an accounting treatment that is acceptable under IFRS, U.S. GAAP, both, or neither by checking the appropriate box.

Transcribed Image Text:

Acceptable Under IFRS U.S. GAAP Both Neither • Bank overdrafts are netted against cash rather than being recognized as a liability when overdrafts are a normal part of cash management. • Uncertain legal obligations, but not constructive obligations, contingent upon a future event are recognized as liabilities when certain criteria are met. • A defined benefit pension liability is measured as the excess of the present value of the defined benefit obligation (PVDBO) over the fair value of plan assets (FVPA). Actuarial gains and losses in a defined benefit pension plan are amor- tized to net income over a period of time. • The compensation cost associated with graded-vesting stock options is amortized to ex pense on a straight-line basis over the vesting period. • The minimum amount recognized as compensation ex pense on a stock option plan is the compensation cost as measured at the grant date, even if a subsequent modification to the plan decreases the total compensation cost. • Deferred taxes are classified as current or noncurrent based on the classification of the related asset or liability. • A payment on a two-year operating lease is recorded in the operating section of the statement of cash flows. • Breakage revenue is recorded on a gift card liability. • Fair value gains from holding marketable equity securities are recorded in other comprehensive income (OCI).

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 64% (14 reviews)

Acceptable Treatments Acceptable under IFRS US GAAP Both Neither Bank overdrafts are netted against ...View the full answer

Answered By

Charles mwangi

I am a postgraduate in chemistry (Industrial chemistry with management),with writing experience for more than 3 years.I have specialized in content development,questions,term papers and assignments.Majoring in chemistry,information science,management,human resource management,accounting,business law,marketing,psychology,excl expert ,education and engineering.I have tutored in other different platforms where my DNA includes three key aspects i.e,quality papers,timely and free from any academic malpractices.I frequently engage clients in each and every step to ensure quality service delivery.This is to ensure sustainability of the tutoring aspects as well as the credibility of the platform.

4.30+

2+ Reviews

10+ Question Solved

Related Book For

International Accounting

ISBN: 978-1260466539

5th edition

Authors: Timothy Doupnik, Mark Finn, Giorgio Gotti, Hector Perera

Question Posted:

Students also viewed these Business questions

-

Indicate whether each of the following statements is true or false by writing T or F in the answer column. 1. Contracts for sale can be oral or written, express or implied. 1. ___________ 2. A...

-

Indicate whether each of the following accounts would be reported on the balance sheet (BS) or income statement (IS) of Home Repair Company. Further, if the account is reported on the balance sheet,...

-

Indicate whether each of the following items would result in net cash flow from operating activities being higher (H) or lower (L) than net income. (a) Decrease in accounts payable. (b) Depreciation...

-

Asset allocation explains a large portion of a portfolio return. However, the implementation issues involved inthe asset allocation process may reduce the efficiency of the asset allocation strategy,...

-

Why are terms such as machinability, formability, and weld-ability considered to be poorly defined and therefore quite nebulous?

-

The table illustrates a sample of maintenance task times (in hours). 20.04 19.59 24.31 25.22 20.63 19.18 15.22 15.59 17.11 22.49 17.92 17.24 17.41 17.44 20.27 20.47 21.23 26.02 16.96 26.28 20.50...

-

Under SFAS 131, which ofthe following items of information is Most Company not required to dis close, even if it were material in amo LO3unt? a. Revenues generated from sales of its consumer products...

-

Beverly and Ken Hair have been married for 3 years. Beverly works as an accountant at Cypress Corporation. Ken is a full-time student at Southwest Missouri State University (SMSU) and also works...

-

Use the graphical approach to CVP analysis to solve the following problem. Valley Peat Ltd, sells peat moss for $10 per bag. Variable costs are $7.50 per bag and annual fixed costs are $100,000 a....

-

Presented below are selected transactions on the books of Simonson Corporation. May 1, 2017 Bonds payable with a par value of $900,000, which are dated January 1, 2017, are sold at 106 plus accrued...

-

On January 1, Year 1, Autonomous Systems Ltd. (ASL) signed a contract to lease computer equipment from Lenovo for three years. The lease agreement requires ASL to pay $30,000 at the end of each year...

-

Portofino Company made purchases on account from three foreign suppliers on December 15, 2017, with payment made on January 15, 2018. Information related to these purchases is as follows: Portofino...

-

In Problems, graph the solution of each system of inequalities. + 9 + 2 12 + 2y 8 x 0, y 2 0

-

Below is a running shock tube illustration. 0.1 0.0 | 0.0 4 4 Diaphragm 1 0.5 Image: Shock tube Initial setup 1 3 2 1 Expansion Head Expansion Tail Slip Shock Surface Image: Running Shock Tube...

-

As you may remember, Holiday Tree Services, Inc. (HTS) has recently entered into a contract with Delish Burger (Delish), whereby HTS is to supply and decorate a Christmas tree in each of Delish...

-

Understanding various types of leadership styles is important in order to determine personal leadership styles. Reflection: Answer both Compare and contrast 2 leadership styles. State the...

-

Operating data for Oriole Corporation are presented as follows. 2025 2024 Net sales $831,900 $629,500 Cost of goods sold 529,700 410,900 Selling expenses 125,400 74,300 Administrative expenses 79,400...

-

A bird traveled 72 miles in 6 hours flying at constant speed. At this rate, how many miles did the bird travel in 5 hours? 12 O 30- O 60 14.4 I don't know (I need help with these type of questions)

-

In 2024, Long Construction Corporation began construction work under a three-year contract. The contract price is $1,600,000. Long recognizes revenue over time according to percentage of completion...

-

If (x) 0 on the interval [a, b], the definite integral gives the exact area under the curve between x = a and x = b.

-

As a result of a downturn in the economy, Optiplex Corporation has excess productive capacity. On January 1, Year 3, Optiplex signed a special order contract to manufacture custom-design generators...

-

The entire inventory of Product Z that was on hand at December 31, Year 1, was completed in Year 2 at a cost of $1,800 and sold at a price of $17,150. Required: a. Determine the impact that Product Z...

-

Beech Corporation has three finished products (related to three different product lines) in its ending inventory at December 31, Year 1. The following table provides additional information about each...

-

Sociology

-

I am unsure how to answer question e as there are two variable changes. In each of the following, you are given two options with selected parameters. In each case, assume the risk-free rate is 6% and...

-

On January 1, Interworks paid a contractor to construct a new cell tower at a cost of $850,000. The tower had an estimated useful life of ten years and a salvage value of $100,000. Interworks...

Study smarter with the SolutionInn App