Question: Consider three different processors P1, P2, and P3 executing the same instruction set with the clock rates and CPIs given in the following table. We

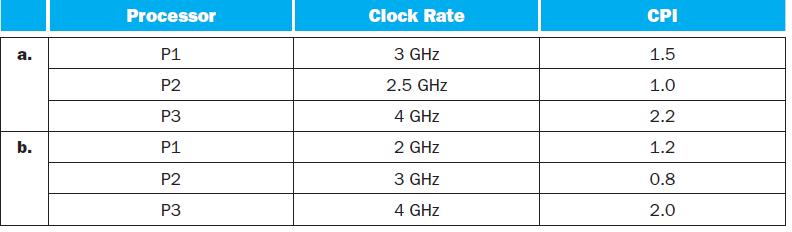

Consider three different processors P1, P2, and P3 executing the same instruction set with the clock rates and CPIs given in the following table.

We are trying to reduce the time by 30% but this leads to an increase of 20% in the CPI. What clock rate should we have to get this time reduction?

a. b. Processor P1 P2 P3 P1 P2 P3 Clock Rate 3 GHz 2.5 GHz 4 GHz 2 GHz 3 GHz 4 GHz CPI 1.5 1.0 2.2 1.2 0.8 2.0

Step by Step Solution

3.45 Rating (168 Votes )

There are 3 Steps involved in it

To reduce the execution time by 30 we need to find a new clock rate that achieves this while also co... View full answer

Get step-by-step solutions from verified subject matter experts