Assume that in problem 37, the United Express Company sells a truck that cost $50,000 in 2021

Question:

Assume that in problem 37, the United Express Company sells a truck that cost $50,000 in 2021 for $15,000 in June 2024. Assume that none of the truck was expensed in 2021. Compute the adjusted basis of the truck and the gain or loss from the sale.

Data From Problem 37

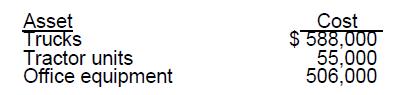

The United Express Company begins business in August 2021 by purchasing the assets listed in the table below. If United Express elects not to claim bonus depreciation, calculate the maximum MACRS depreciation on the assets.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Concepts In Federal Taxation 2022

ISBN: 9780357515785

29th Edition

Authors: Kevin E. Murphy, Mark Higgins, Tonya K. Flesher

Question Posted: