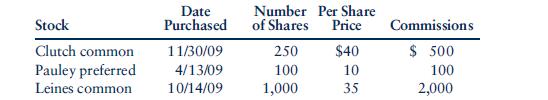

At the beginning of 2010, Heather owns the following stocks: In addition to these stocks, Heather received

Question:

At the beginning of 2010, Heather owns the following stocks:

In addition to these stocks, Heather received 400 shares of Poor Boy preferred stock from her grandfather as a gift on December 25, 2009. The shares were selling for $25 per share on December 24, 2009. No gift tax was paid on the transfer of the stock.

Her grandfather had purchased the shares for $5 per share in 1994.

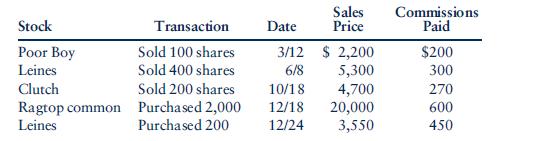

During 2010, Heather has the following stock transactions:

a. What is Heather’s net capital gain or loss for 2010?

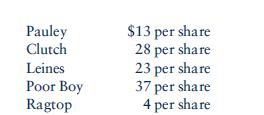

b. On December 28, 2010, Heather’s stocks have the following fair market value:

Assuming that the commission paid on any sale is equal to 5% of the selling price, what action(s) would you recommend to Heather to minimize her 2010 tax? Discuss the potential tax effects of selling each of the stocks Heather owns at the end of the year.

c. Assume that in addition to the stock sales, Heather sells some land she inherited from her father. Her father paid $5,000 for the land in 1995. He died on April 14, 2005, when the land was worth $12,000. Heather sells the land on May 21, 2010, for $50,000. Legal fees and commissions of $5,500 are paid on the sale. What is Heather’s net capital gain or loss for 2010?

d. Given the fair market values, what action would you recommend Heather take to minimize her 2010 tax? Explain.

Step by Step Answer:

Concepts In Federal Taxation 2011

ISBN: 9780538467926

18th Edition

Authors: Kevin E. Murphy, Mark Higgins