Question:

For 2023, Alpha Corporation reports \($500,000\) of gross income from business operations and \($625,000\) of allowable business deductions. It also received from a domestic corporation \($150,000\) in dividends for which it is entitled to a 65%

dividends-received deduction. What is Alpha’s taxable income reported on Form 1120?

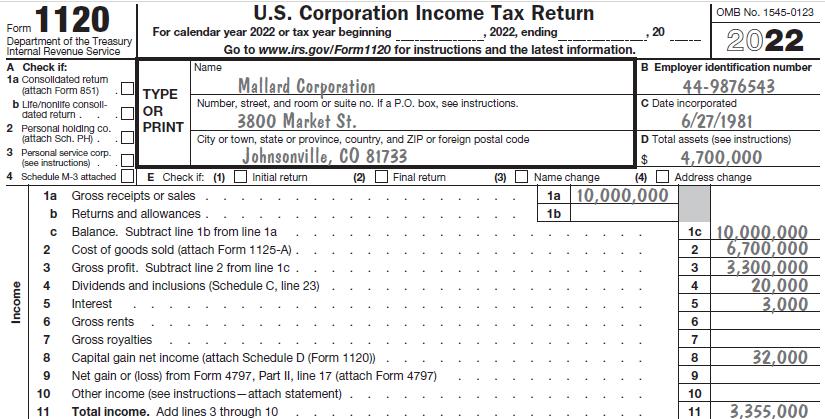

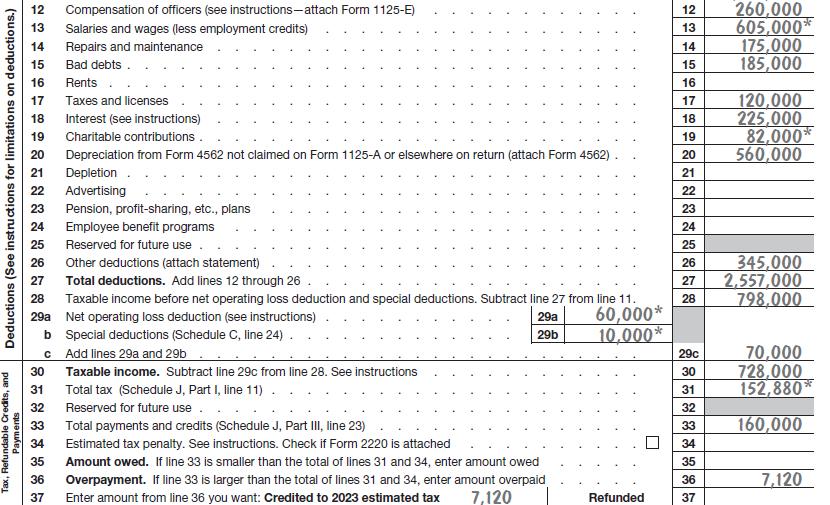

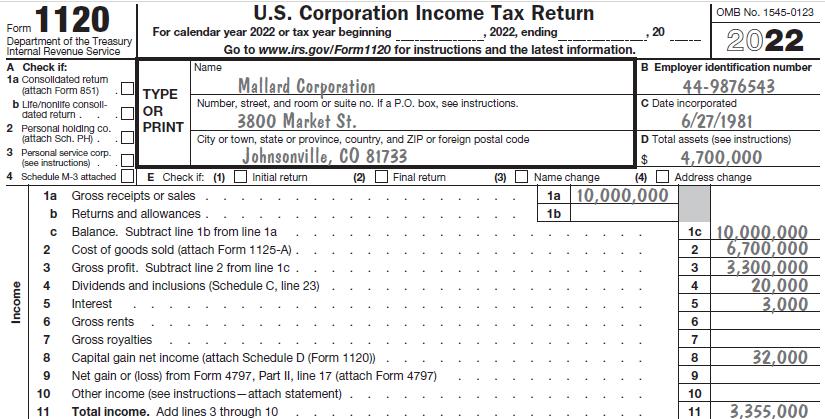

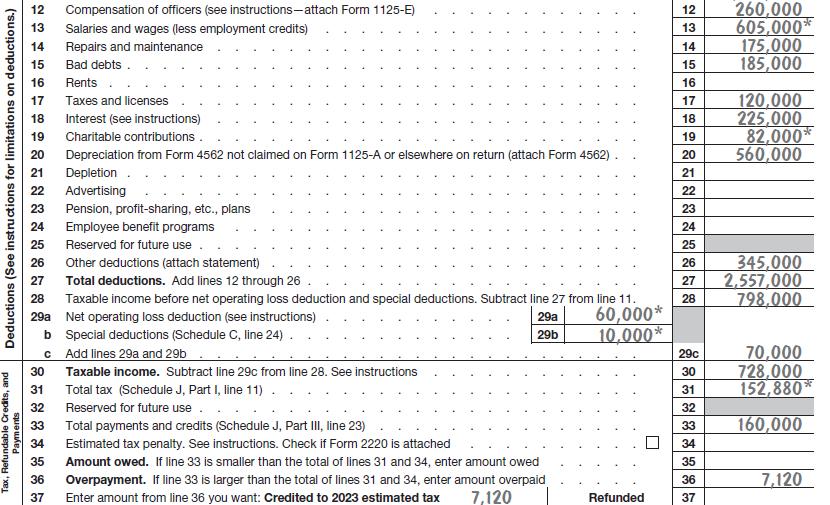

Data From Form 1120

Transcribed Image Text:

Form 1120 Department of the Treasury Internal Revenue Service A Check if: 1a Consolidated retum (attach Form 851) b Life/nonlife consoll- dated return. 2 Personal holding co. (attach Sch. PH). 3 Personal service corp. (see instructions). 4 Schedule M-3 attached Income U.S. Corporation Income Tax Return For calendar year 2022 or tax year beginning ,2022, ending 20 Go to www.irs.gov/Form1120 for instructions and the latest information. Name TYPE OR Mallard Corporation Number, street, and room or suite no. If a P.O. box, see instructions. 3800 Market St. PRINT City or town, state or province, country, and ZIP or foreign postal code Johnsonville, CO 81733 E Check if: (1) Initial return 1a Gross receipts or sales 2 345 6 78 b Returns and allowances. c Balance. Subtract line 1b from line 1a Cost of goods sold (attach Form 1125-A). Gross profit. Subtract line 2 from line 1c Dividends and inclusions (Schedule C, line 23) Interest Gross rents Gross royalties OMB No. 1545-0123 2022 B Employer identification number 44-9876543 C Date incorporated 6/27/1981 D Total assets (see instructions) $ 4,700,000 (2) Final return (3) Name change (4) Address change 1a 10,000,000 1b Capital gain net income (attach Schedule D (Form 1120)) Net gain or (loss) from Form 4797, Part II, line 17 (attach Form 4797) 9 11 10 Other income (see instructions-attach statement). 11 Total income. Add lines 3 through 10 1c 10,000,000 2 6,700,000 3 3,300,000 4 20,000 5 3,000 6 7 8 32,000 9 10 11 3,355,000