Interest and Penalties. In 2023, Paul, who is single, has a comfortable salary from his job as

Question:

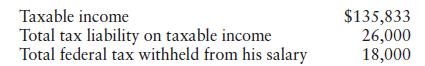

Interest and Penalties. In 2023, Paul, who is single, has a comfortable salary from his job as well as income from his investment portfolio. However, he is habitually late in filing his federal income tax return. He did not file his 2023 income tax return until December 4, 2024 (due date was April 15, 2024) and no extensions of time to file the return were filed. Below are amounts from his 2023 return:

Paul sent a check with his return to the IRS for the balance due of \($8,000.\) He is relieved that he has completed his filing requirement for 2023 and has met his financial obligation to the government for 2023. Has Paul met all of his financial obligations to the IRS for 2023? If not, what additional amounts will Paul be liable to pay to the IRS?

Step by Step Answer:

Pearsons Federal Taxation 2024 Individuals

ISBN: 9780138238100

37th Edition

Authors: Mitchell Franklin, Luke E. Richardson