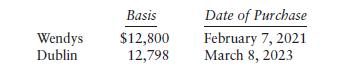

It is August 20, 2023, and Andy, whose tax rate is 32%, owns stock of Wendys and

Question:

It is August 20, 2023, and Andy, whose tax rate is 32%, owns stock of Wendys and stock of Dublin. The FMV of each stock is \($10,000,\) and the commission to sell either stock is \($15.\) Andy has no other sales or exchanges during the year, and he wants to sell either his stock of Wendys or Dublin. His expectation about future price increases is the same for either company. Under what circumstances will it make a difference which stock he sells?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Pearsons Federal Taxation 2024 Individuals

ISBN: 9780138238100

37th Edition

Authors: Mitchell Franklin, Luke E. Richardson

Question Posted: