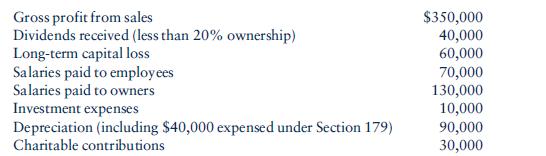

LO1 EndLand Company reports the following results for the current year: a. Assume that EndLand is a

Question:

LO1 EndLand Company reports the following results for the current year:

a. Assume that EndLand is a partnership owned by Kira (60%) and Justin (40%).

Kira receives a salary of $70,000, and Justin receives a salary of $60,000. The salaries are not guaranteed payments. Determine the tax treatment of EndLand’s operating results and the effects of the results on Kira and Justin.

b. Assume the same facts as in part

a, except that EndLand is an S corporation. Determine the tax treatment of EndLand’s operating results and the effect of the results on Kira and Justin.

c. Assume the same facts as in part

b, except that EndLand is an S corporation. Determine the tax treatment of EndLand’s operating results and the effect of the results on Kira and Justin.

Step by Step Answer:

Concepts In Federal Taxation 2011

ISBN: 9780538467926

18th Edition

Authors: Kevin E. Murphy, Mark Higgins