LO11 Myron graduates from college this year and lands a job with the Collingwood Corporation in Dallas.

Question:

LO11 Myron graduates from college this year and lands a job with the Collingwood Corporation in Dallas. After accepting the job, he flies to Dallas to find an apartment.

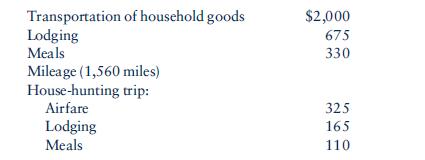

Myron uses $2,000 his grandmother gave him as a graduation gift to pay a moving company to transport his household goods from Atlanta. He doesn’t drive directly to Dallas but goes via Panama City to vacation with friends. In moving to Dallas via Panama City, he incurs the following expenses:

The expenses listed include $375 for lodging and $230 for meals in Panama City.

The direct mileage between Atlanta and Dallas is 1,340 miles. When Myron arrives in Dallas, he is informed that the moving van has mechanical problems and will not arrive for two days. Instead of sleeping on the apartment floor, he stays in a local hotel, paying $55 per night; he also spends $60 for meals. What is Myron’s allowable moving deduction?

Step by Step Answer:

Concepts In Federal Taxation 2011

ISBN: 9780538467926

18th Edition

Authors: Kevin E. Murphy, Mark Higgins