LO2 Pablo is a computer sales representative and spends only 4 days a month in the office.

Question:

LO2 Pablo is a computer sales representative and spends only 4 days a month in the office. His office is 18 miles from home. Pablo spends 3 nights a month traveling to his out-of-town clients.

a. What portion of Pablo’s travel is considered business?

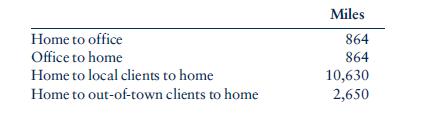

b. During the year, Pablo keeps the following record of his travel: .

.

The company reimburses Pablo for all of his lodging, meals, and entertainment while he is on the road. If he uses the standard mileage rate, what amount can he deduct as a business expense?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Concepts In Federal Taxation 2011

ISBN: 9780538467926

18th Edition

Authors: Kevin E. Murphy, Mark Higgins

Question Posted: