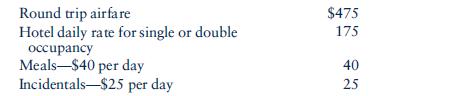

LO3 Juanita travels to San Francisco for 7 days. The following facts are related to the trip:

Question:

LO3 Juanita travels to San Francisco for 7 days. The following facts are related to the trip:

a. If she spends 4 days on business and 3 days sightseeing, what amount may she deduct as travel expense?

b. If she spends 2 days on business and 5 days sightseeing, what amount may she deduct as travel expense?

c. Assume the same facts as in part

a, except that Juanita’s husband Jorge accompanied her on the trip and that the hotel’s single occupancy rate is $150. Jorge went sightseeing every day and attended business receptions with Juanita at night.

Assume that Jorge’s expenses are identical to Juanita’s. What amount may Juanita and Jorge deduct as travel expense?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Concepts In Federal Taxation 2011

ISBN: 9780538467926

18th Edition

Authors: Kevin E. Murphy, Mark Higgins

Question Posted: