LO4,8,9 Assume that the building in problem 67 is an apartment building held for investment. In addition

Question:

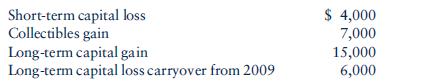

LO4,8,9 Assume that the building in problem 67 is an apartment building held for investment. In addition to the sale of the building, Anton has the following capital gains and losses during 2010:

Anton is married and has a taxable income of $140,000 without considering his capital gains and losses. What is his taxable income and income tax liability?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Concepts In Federal Taxation 2011

ISBN: 9780538467926

18th Edition

Authors: Kevin E. Murphy, Mark Higgins

Question Posted: