LO5 Chloe and Emma start a new business, Cement Sidewalks and Accessories (CSA), during the current year.

Question:

LO5 Chloe and Emma start a new business, Cement Sidewalks and Accessories

(CSA), during the current year. CSA is organized as a partnership. Chloe owns 40%

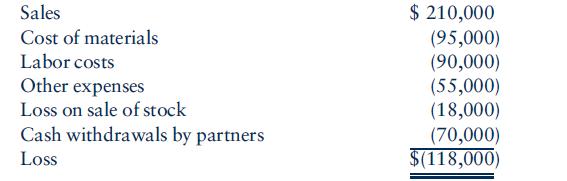

of CSA; Emma owns the remaining 60%. Chloe and Emma come to your firm for advice on the tax consequences of their business. Your supervisor gives you the following information, as prepared by Chloe and Emma for their first year of operation:

Prepare a memo for your supervisor explaining the ramifications of CSA’s first-year results for Chloe’s and Emma’s tax liabilities.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Concepts In Federal Taxation 2011

ISBN: 9780538467926

18th Edition

Authors: Kevin E. Murphy, Mark Higgins

Question Posted: