LO8 Bongo Corporation is incorporated in 2008. It has no capital asset transactions in 2008. From 2009

Question:

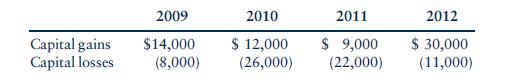

LO8 Bongo Corporation is incorporated in 2008. It has no capital asset transactions in 2008. From 2009 through 2012, Bongo has the following capital gains and losses:

Assuming that Bongo’s marginal tax rate during each of these years is 34%, what is the effect of Bongo’s capital gains and losses on the amount of tax due each year?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Concepts In Federal Taxation 2011

ISBN: 9780538467926

18th Edition

Authors: Kevin E. Murphy, Mark Higgins

Question Posted: