Lou and Stella North are married, file a joint return, and have two dependent children in college,

Question:

Lou and Stella North are married, file a joint return, and have two dependent children in college, Phil and Jaci.

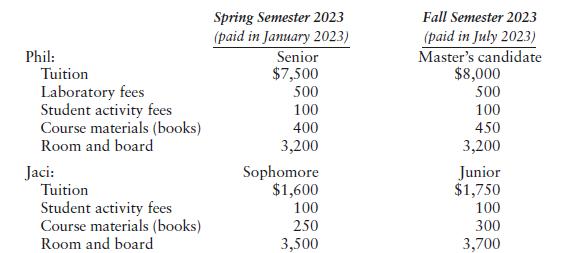

Phil attends a State University in a neighboring state, and Jaci attends a State University in their home state. Neither receives any type of financial assistance. The Norths’ modified AGI in 2023 is \($122,000.\) The children’s classifications and expenses are as follows:

a. Compute any education credits that the Norths may claim in 2023.

b. How would your answer in Part a change if Phil received an academic scholarship of \($3,000\) (excluded from gross income) for each semester?

c. How would your answer in Part a change if Lou and Stella’s modified AGI was \($175,000\)?

d. How would your answer in Part a change if Phil had been a junior during Spring semester and a senior during Fall semester?

Step by Step Answer:

Pearsons Federal Taxation 2024 Individuals

ISBN: 9780138238100

37th Edition

Authors: Mitchell Franklin, Luke E. Richardson