Mike, a self-employed consultant, incurs the following business-related expenses in 2023: Mike earned ($130,000) of gross income

Question:

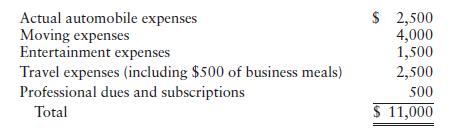

Mike, a self-employed consultant, incurs the following business-related expenses in 2023:

Mike earned \($130,000\) of gross income from his consulting business and had \($12,000\) of interest and dividend income in 2023 before any of the above expenses are deducted. He has \($20,000\) of itemized deductions. Mike is married and files a joint return with his wife, Ann, who has no income.

a. What is the amount of Mike’s deduction for business-related expenses for 2023?

b. What is Mike and Ann’s AGI and taxable income in 2023, assuming he is married and files a joint return, and ignoring the self-employment tax?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Pearsons Federal Taxation 2024 Individuals

ISBN: 9780138238100

37th Edition

Authors: Mitchell Franklin, Luke E. Richardson

Question Posted: