Nick and Jolene are married. Nick is 61 and retired in 2009 from his job with Amalgamated

Question:

Nick and Jolene are married. Nick is 61 and retired in 2009 from his job with Amalgamated Company. Jolene is 56 and works part-time as a special education teacher.

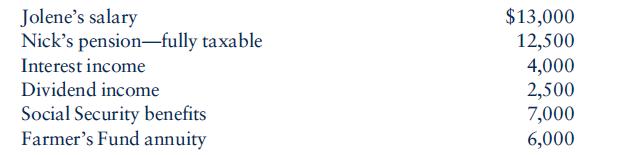

Nick and Jolene have a substantial amount of investment savings and would like to reorganize it to achieve the best after-tax return on their investments. They give you the following list of projected cash receipts for 2010:

In addition, Nick tells you that he owns a duplex that he rents out. The duplex rents for 2010 are $18,000, and Nick estimates expenses of $22,000 related to the duplex.

The annuity was purchased 18 years ago for $20,000, and pays $500 per month for 10 years.

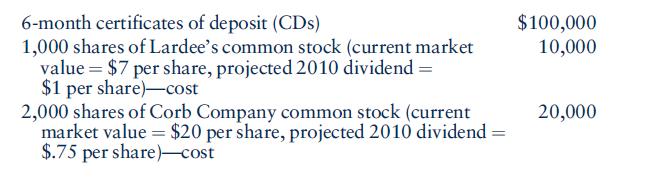

Nick and Jolene’s investments consist of the following:

a. Assuming that Nick and Jolene have total allowable itemized deductions of $12,350 in 2010 and that they have no dependents, determine their 2010 taxable income and tax liability based on the projections they gave you.

b. The 6-month CDs consist of two $50,000 certificates, both of which yield 4% interest.

One CD matures on January 3, 2010. Nick’s banker tells him that he can renew the CD for one year at 4%. Nick’s stockbroker tells him that he can purchase tax-exempt bonds with a yield of 3%. Nick would like you to determine whether the tax-exempt bonds provide him a better after-tax return than the CD.

c. Jolene is concerned that they are not getting the best return on their Corb Company stock. When they purchased the stock in 1999, the $.75 per share dividend was yielding 10% before taxes. However, the rise in market value has far outpaced the dividend growth, and it is yielding only 3.75%, based on the current market value.

Jolene thinks they should sell the stock and purchase either the 3% tax-exempt securities or the 4% CD if it would be a better deal from an income tax viewpoint.

Calculate the tax effect on their 2010 income of selling the shares, and determine whether they should sell the shares and invest the after-tax proceeds in tax-exempt securities or the 4% CD. Do this calculation after you have determined the best option regarding the CD that matures in January.

Step by Step Answer:

Concepts In Federal Taxation 2011

ISBN: 9780538467926

18th Edition

Authors: Kevin E. Murphy, Mark Higgins