Reba's 2018 income tax calculation is as follows: Before filing her return, Reba finds an $8,000 deduction

Question:

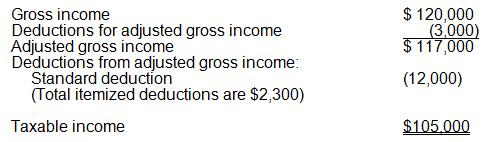

Reba's 2018 income tax calculation is as follows:

Before filing her return, Reba finds an $8,000 deduction that she omitted from these calculations. Although the item is clearly deductible, she is unsure whether she should deduct it for or from adjusted gross income. Reba doesn't think it matters where she deducts the item, because her taxable income will decrease by $8,000 regardless of how the item is deducted. Is Reba correct? Calculate her taxable income both ways. Write a letter to Reba explaining any difference in her taxable income arising from whether the $8,000 is deducted for or from adjusted gross income.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Concepts In Federal Taxation

ISBN: 9781337702621

26th Edition

Authors: Kevin E. Murphy, Mark Higgins

Question Posted: